- Market Minute

- Posts

- Analysts Boo Netflix (NFLX) Before Tuesday’s Earnings as Warner Bros. Deal Remains Uncertain

Analysts Boo Netflix (NFLX) Before Tuesday’s Earnings as Warner Bros. Deal Remains Uncertain

Netflix (NFLX) will report earnings after Tuesday’s close with a giant question mark still looming for investors; the battle between now-archrivals Netflix and Paramount Skydance (PSKY) to acquire Warner Bros. Discovery (WBD). More twists in this drama came late last week on reports that Netflix is preparing to revise its $82.7B offer to an all-cash deal, and that Paramount’s lawsuit attempting to force additional financial disclosures about the deal was rejected by a Delaware court.

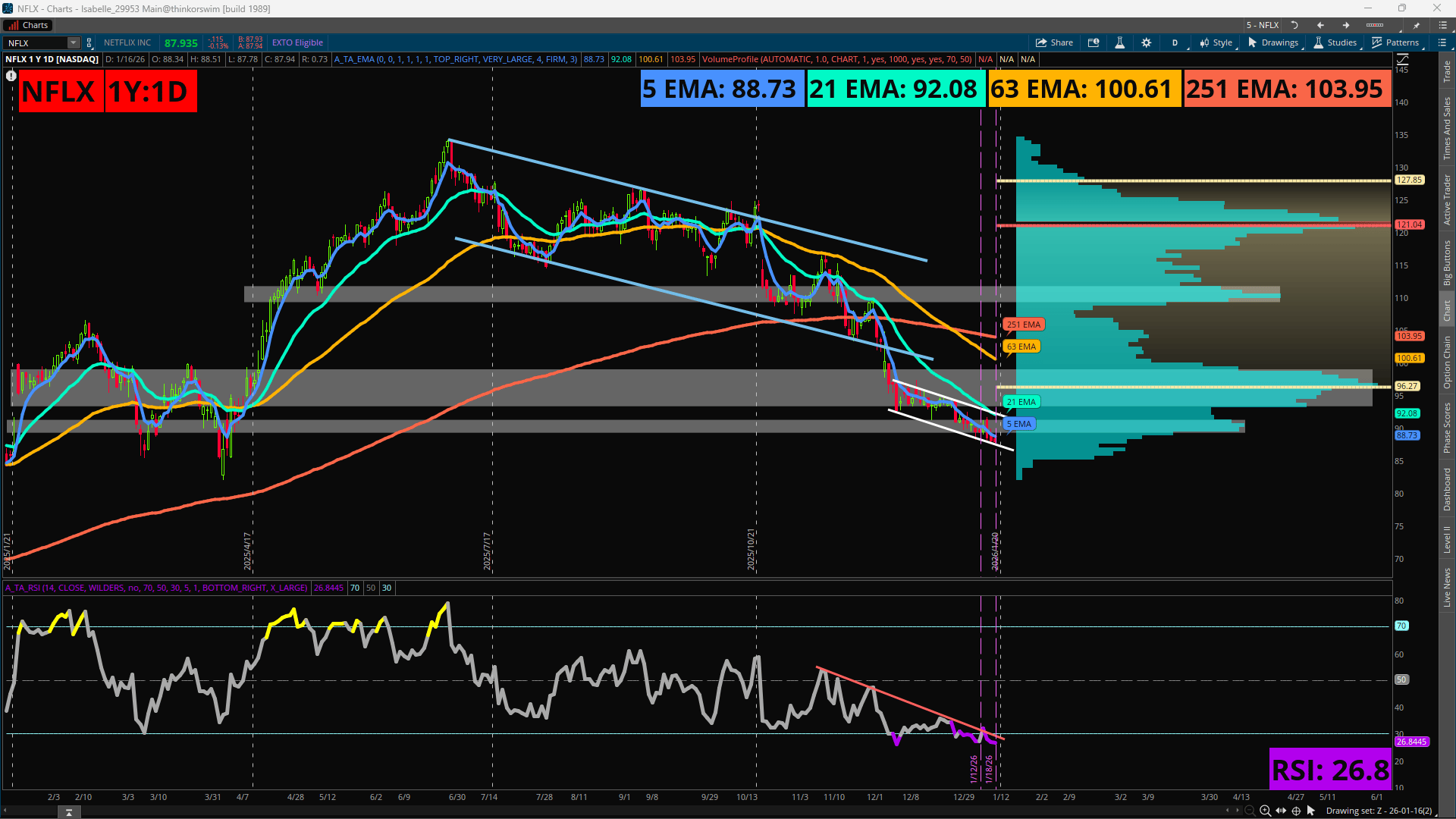

The streaming giant faces a stock price that has slumped more than 34% since hitting its all-time high of 134.12 on Jun. 30, with the Street’s expectations for EPS of $0.55 against last year’s figure of $0.43 (+27.9%) and for revenue of $11.97B vs. $10.25B (+16.8%) one year ago. The Jan. 23 Friday options expiration shows a potential expected move of about +/- 7.1 (8.1%), meanwhile the next monthly expiration for Feb. 20 projects a move of +/-10.2 (11.6%).

Meanwhile, analysts seem to have soured on Netflix heading into earnings. Keybanc on Friday cut its price target to $110 from $139 and kept its buy. Meanwhile, Wedbush also last week cut its price target to $115 from $140 but kept its outperform rating, adding that Netflix’s ad business growth will be crucial for the company and that users could start seeing interactive advertising. Other recent moves include: TD Cowen lowering its target to $115 from $142 and keeping its buy rating; and Goldman Sachs reducing its target to $112 from $130 while keeping its hold rating.

The technical picture shows shares experiencing a gradual descent from the aforementioned highs that largely fit between a downward channel shape, but faced a downside breakthrough in early December. More recently, shares have regrouped and the activity has resumed a similar trajectory, forming a new downward channel that is smaller and narrower and threatens to test the 52-week lows of 82.11.

Downside momentum has slowed somewhat after repeated entries into the oversold area into what may be viewed as mild bullish divergence from price, but waning momentum heading into earnings is common so this information should be viewed with a grain of salt. Price also remains below a small node according to the yearly Volume Profile study centered roughly around the 90 area, with the next notable heavy trading activity price level coming in near 96. To the downside, the 83 to 85 area presents a critical support zone for the bulls to hold.

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.