- Market Minute

- Posts

- Broad Market Participation Eases Tech Pain

Broad Market Participation Eases Tech Pain

Despite a busy week of market-moving events, from the Federal Reserve cutting interest rates and introducing a Treasury bill purchasing program to Oracle’s (ORCL) disappointing earnings report, one clear winner emerged: the broadening trade.

Technology stocks continued to face pressure, but underloved and often overlooked sectors stepped into the spotlight. Materials, Financials, and Industrials were the top performing sectors this week as markets began to position for easier monetary policy and the potential for a reflationary environment heading into next year. Value-oriented companies also saw strong inflows, as their valuation multiples remain discounted relative to the S&P 500, particularly when compared with the Technology and Communication Services sectors, which have commanded premium valuations for an extended period.

While opportunities remain across the market as the year winds down, this rotation can also act as a headwind for cap-weighted indexes such as the S&P 500 (SPX) and the Nasdaq-100 (NDX). Both indexes have benefited significantly in 2025 from concentrated leadership within Technology and Communication Services for the better part of the year, making them more sensitive to any sustained sector rotation.

From a technical standpoint, the S&P 500 managed to register new closing highs during the week, but Friday’s pullback, driven by concerns over delayed data center buildouts, introduced some caution. Importantly, the selloff pushed the index back into the trading range that has been intact since November 28, suggesting broader support remains in place at least for now.

Momentum indicators, however, warrant close monitoring. The Relative Strength Index (RSI) continues to make lower highs, signaling waning price momentum and aligning with the consolidation seen over the past two weeks. Meanwhile, the MACD (Moving Average Convergence/Divergence) 12-day EMA is trending lower and appears vulnerable to a bearish crossover if the S&P 500 continues to move sideways into the end of next week.

The broadening trade has created a healthy set of opportunities across the market in recent weeks, but investors should remain mindful of its potential impact on the performance of key benchmark indexes as leadership continues to rotate.

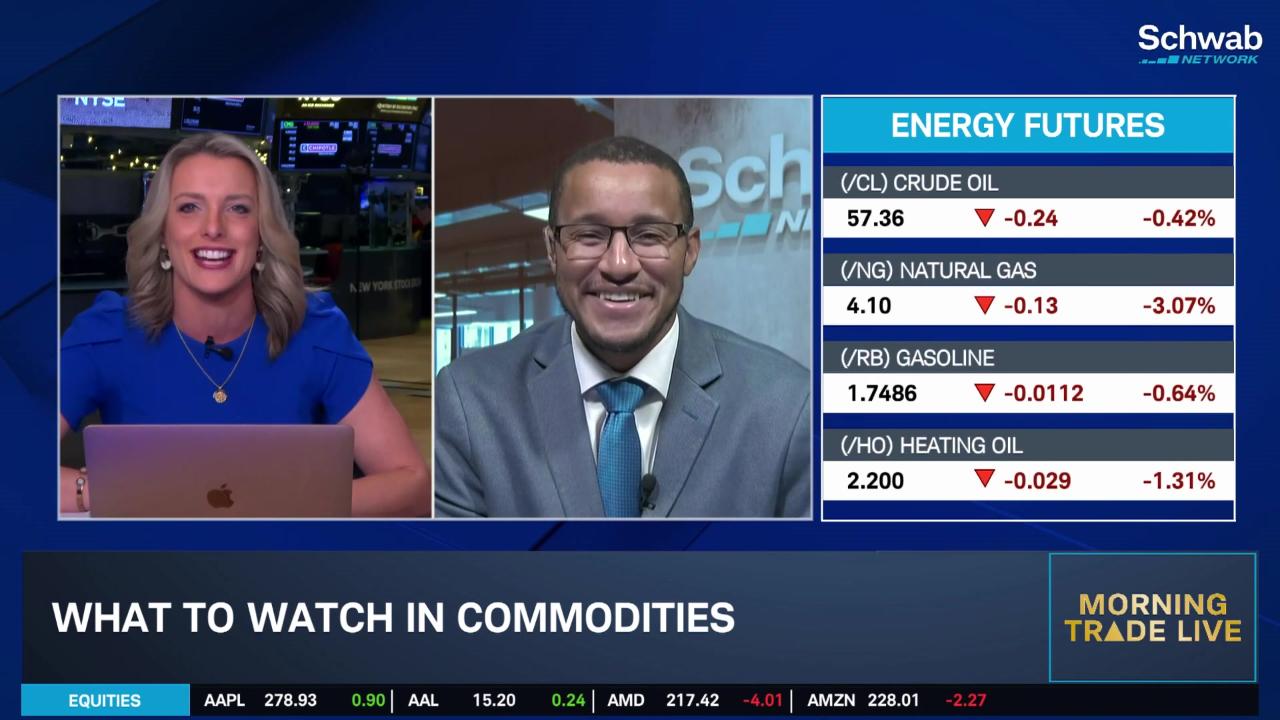

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.