- Market Minute

- Posts

- Earnings Matter Again as Tech Fractures Near the Highs

Earnings Matter Again as Tech Fractures Near the Highs

The week was defined by sharp intraday swings, heavy earnings dispersion, and clear cross-asset signals that investors are becoming more selective as U.S. equities hover near record territory.

Markets opened the week with a large early selloff, driven by renewed pressure in mega-cap technology and other growth-sensitive assets. That initial downside was met with steady dip buying, allowing major indexes to recover a meaningful portion of losses by the close. Even with those rebounds, the S&P 500 (SPX) again failed to hold above the 7,000 level, underscoring how fragile upside momentum has become without broader participation from technology leadership.

Central bank messaging remained a critical anchor for sentiment. At Wednesday’s FOMC meeting, policymakers held rates steady, as widely expected, but reinforced a posture of patience rather than urgency. Chair Powell acknowledged continued progress on inflation, particularly in goods prices, while emphasizing that services inflation and labor cost pressures remain elevated.

The Committee also highlighted that financial conditions have eased meaningfully, pointing to lower real yields, tighter credit spreads, and a weaker U.S. dollar. That easing, in the Fed’s view, reduces the need for near-term rate cuts and places greater emphasis on incoming data. Markets interpreted the meeting as neutral to mildly dovish, supportive for risk assets but not an invitation for aggressive multiple expansion.

Sector performance reflected that nuance. Communication Services led the S&P 500, powered by strong gains in Meta Platforms (META) after earnings showed resilient advertising demand, improving engagement trends, and disciplined cost control. Energy and utilities also finished higher as investors leaned into defensive and cash-flow-oriented exposure amid rising equity dispersion. Energy stocks found additional support from firmer crude prices, with WTI Crude Oil trading above $65 per barrel for much of the week, reinforcing confidence in cash flows and balance sheets across the sector.

By contrast, Consumer Discretionary was the weakest sector, pressured by slowing growth expectations and concerns that higher borrowing costs could weigh on household demand.

Commodities and currencies sent a consistent message of risk awareness. Gold, silver, and copper continued to trend higher to start the week but experienced some outsized volatility during Thursday and Friday’s session. The metals trade was supported by falling real yields, geopolitical uncertainty, and persistent U.S. Dollar ($DXY) weakness. Strength in copper added a cyclical dimension to the metals rally, suggesting infrastructure and electrification demand remains intact even as growth expectations cool. The U.S. dollar weakened broadly, while the Japanese Yen (USD/JPY) strengthened as rate differentials narrowed amid Japan’s gradual policy normalization. Dollar softness eased funding pressure for emerging market equities and debt, helping improve risk appetite across EM assets.

At the same time, risk appetite showed signs of strain in alternative assets. Bitcoin broke below key technical support levels during the week, highlighting its role as a high-beta risk barometer rather than a defensive hedge. The cryptocurrency’s weakness contrasted sharply with the strength in precious metals and underscored a broader shift away from speculative, liquidity-sensitive exposures.

Earnings were the primary driver of equity-level dispersion. Results from Microsoft (MSFT) weighed heavily on sentiment after commentary raised concerns about cloud growth durability and enterprise spending visibility. That disappointment rippled through application software, pulling down Salesforce (CRM), SAP (SAP), Intuit (INTU), and Oracle (ORCL) in sympathy. The software selloff was a key reason the S&P 500 struggled to sustain intraday rebounds despite strength elsewhere.

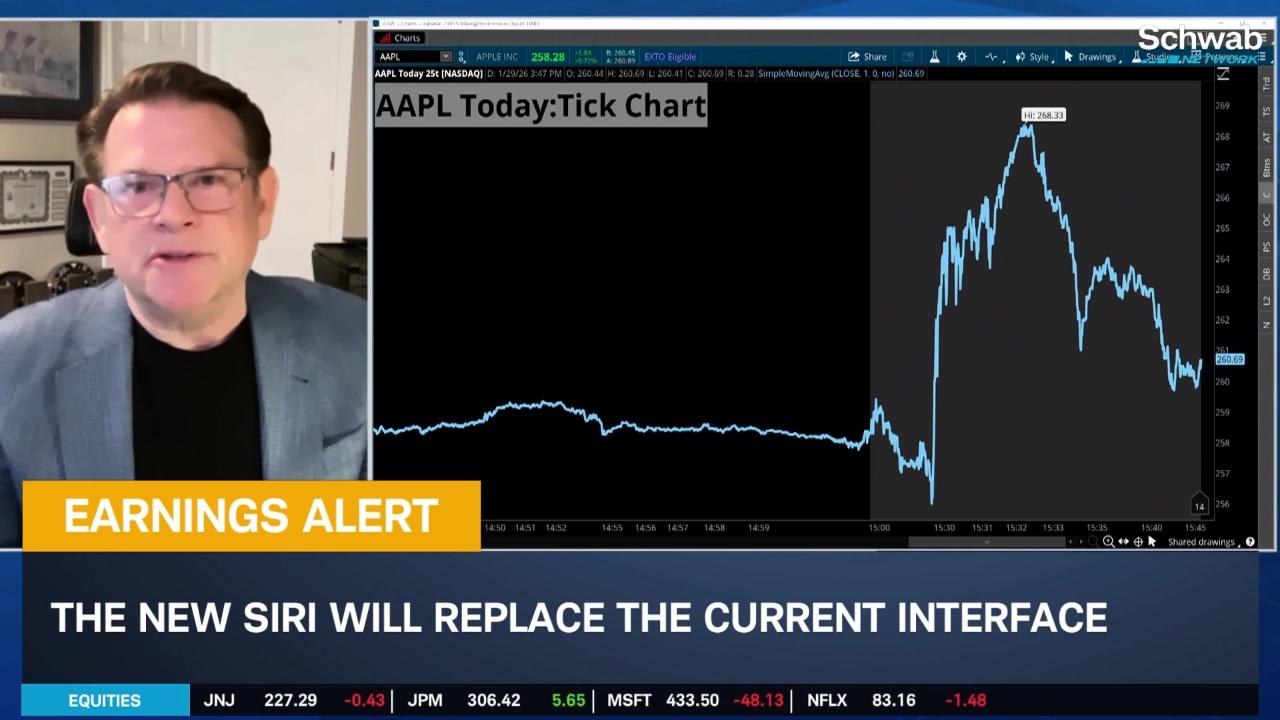

The most closely watched report of the week came from Apple (AAPL), whose results provided a stabilizing anchor amid broader tech volatility. Apple reported earnings per share of $2.84, well ahead of consensus expectations, while revenue rose 15.7% year over year to $143.76 billion, topping estimates. Growth was broad-based. Product revenue increased 16% to $107.7 billion, led by a 23% surge in iPhone revenue to $85.27 billion, while services revenue climbed 16% to $30 billion, reinforcing the durability of Apple’s high-margin recurring revenue base. Investors were also encouraged by a 38% year over year rebound in China sales to $25.5 billion, easing concerns that regional weakness could become structural.

As the market moves toward the end of a volatile week, the tone has become more reflective than reactive. Early selling pressure, sharp intraday reversals, and narrowing leadership all highlighted a market still willing to buy weakness, but far less forgiving of disappointment. Defensive sectors, precious metals, and energy continued to attract capital, while growth and software names face tighter scrutiny.

Looking ahead, the coming week brings another dense slate of catalysts. Investors will focus on employment cost data, ISM manufacturing, and updated labor market indicators to assess whether inflation pressures continue to cool without undermining growth. Earnings season remains in full force, with major reports due from Amazon (AMZN), Alphabet (GOOGL), Exxon Mobil (XOM), Chevron (CVX), and Pfizer (PFE).

With crude holding above $65, metals still trading at historic levels, Bitcoin breaking down, and equities struggling to extend beyond record levels, the next leg for markets will hinge on whether earnings can restore confidence in growth leadership or whether defensive positioning continues to define the tape.

Morning Minute

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.