- Market Minute

- Posts

- Gold and Bitcoin Both Moving Higher Amid Government Shutdown Uncertainty

Gold and Bitcoin Both Moving Higher Amid Government Shutdown Uncertainty

“Everything is worth what its purchaser will pay for it.” – Pubilius Syrus, ~50 B.C.

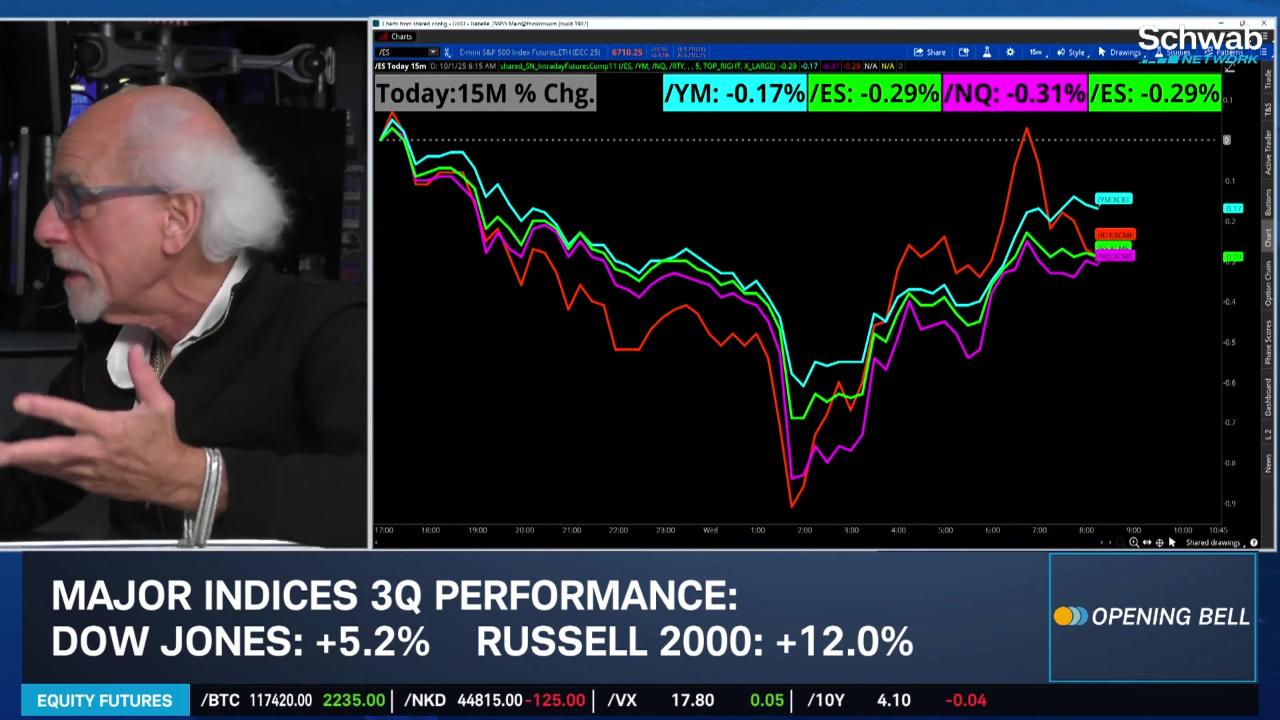

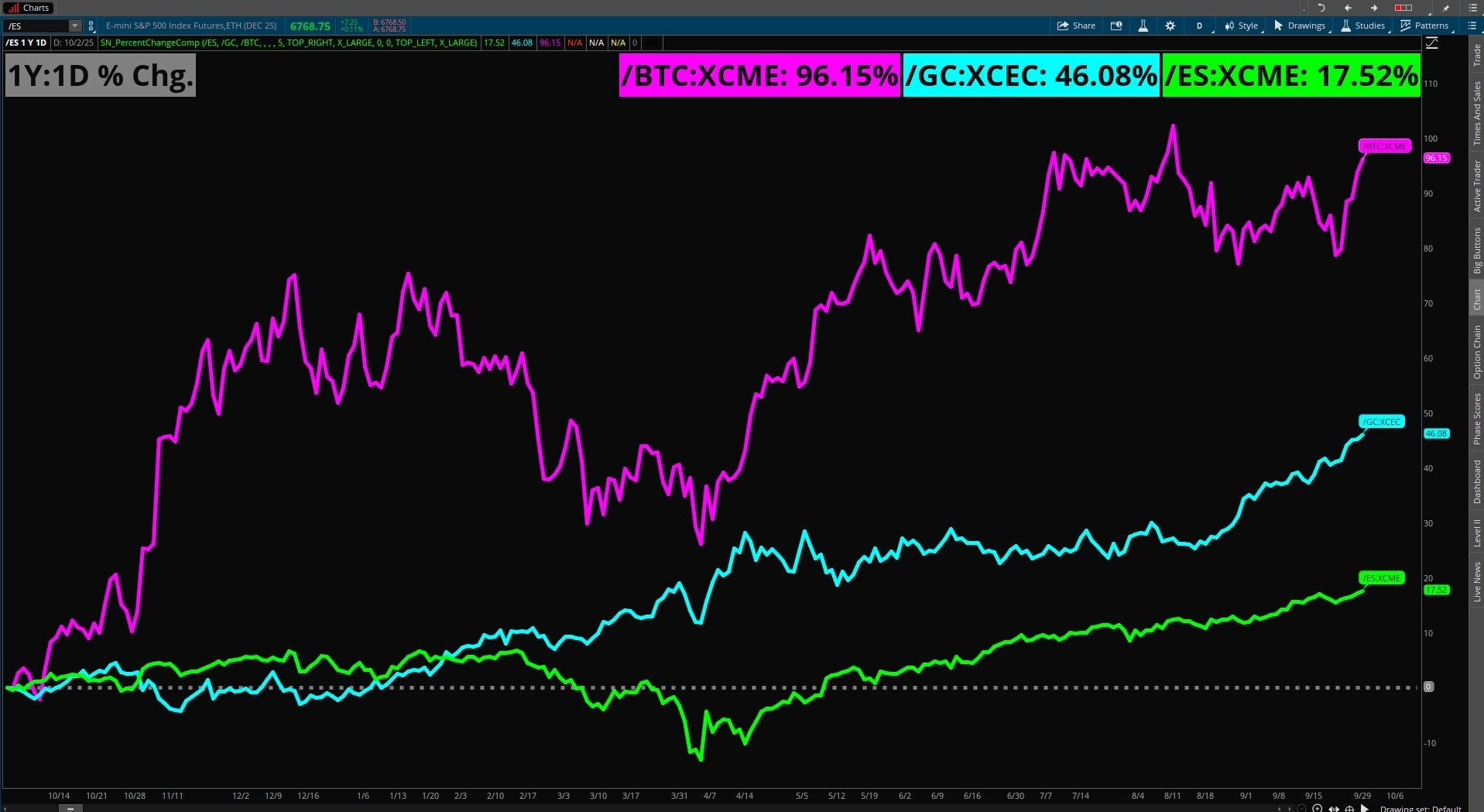

Gold (/GC) and Bitcoin (/BTC) futures are both on the move to the upside this morning as the second day of the U.S. government shutdown begins, which means traders could be focused on these products because they can be viewed as “stores of value” that offer a potential alternative to the U.S. dollar during uncertain times.

By one way of thinking, it is curious that both gold and Bitcoin are near their all-time highs. Many view gold as a safety play because it has been a treasured commodity around the world for thousands of years. Conversely, Bitcoin is the upstart asset that took the trading community by storm less than 20 years ago, with massive volatility that offers the possibility of tremendous gains or losses to the unwary.

Another thought is that gold is simple and known by practically everyone as something valuable, whereas bitcoin has more of a question mark around its perceived value and ease of use. Relatively few people understand what bitcoin is and how it works, with only about 14% of American adults owning the cryptocurrency according to a 2025 Gallup survey. But regardless of anyone’s opinions about either product, the prices of both assets have shown strong upside activity recently.

Examining the heavily traded SPDR Gold ETF (GLD), price had a major breakout in early September after a long period of sideways trading that compressed in an increasingly narrowing range between about 300 to 315. Price was little changed overall yesterday but still managed to notch another fresh all-time high close of 356.03 making for about a +11% move to the upside since the close of August.

Momentum also is holding up, with the RSI remaining in the overbought area and squeaking out a higher close along with price. Potential support could be found near 347 based on the confluence of the 9-day Exponential Moving Average and a volume node shown on the yearly Volume Profile study. Beyond that, another node sits close to 335 and could be another potential foothold. In terms of possible resistance, the +1 yearly Standard Deviation Channel comes in at about 366 as of yesterday’s close.

For Bitcoin futures, the picture is somewhat different but also intriguing from a bullish perspective. Price is breaking out of a downward trendline that began near the old highs of 125,200 in mid-August. This point near 118,000 also marks double-top ceiling activity where prices stalled out during recent rallies. However, the RSI has not yet shown an accompanying breakout, so look for this study to breach its own downward trendline.

The previously mentioned area near 118k is the first support area, as it also marks the yearly Linear Regression Line and a volume node. Beyond that, price hit a floor near 108k during its recent range. To the upside, price topped out roughly around 123,740 twice, so this is the point to watch on the potential road to new all-time highs.

Morning Minute

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.