- Market Minute

- Posts

- Government Shutdown Comes at Delicate Time for Fed

Government Shutdown Comes at Delicate Time for Fed

The U.S. government shut down overnight as lawmakers failed to come to a funding deal. The last shutdown was in 2018, lasting a record 35 days, during Trump’s first term.

Markets hate uncertainty, and a shutdown certainly qualifies. Stock futures are under pressure on the news and Gold (/GC) hit record highs – again – as investors seek safe havens.

Historically, markets have navigated previous shutdowns will little negative impact, but could this one be different? The length of the shutdown may impact markets along with inflation concerns and weakening jobs data. Around 750K American workers could be furloughed, which can potentially spike the unemployment rate. Trump has also suggested he will use the shutdown to lay off federal workers en masse. Also keep in mind that about 150K workers will be leaving beginning today as part of the DOGE deferred resignation programs.

Whatever spending deal comes out of this shutdown will have market impacts, but there are other pressing concerns. The Fed’s data sources are being interrupted at a critical time for their easing path. In addition to furloughed workers muddying the unemployment picture, the BLS jobs report due Friday will not be released.

While some parties have raised concerns over the accuracy of the BLS data, the difference between some data and no data shouldn’t be underestimated. The agency itself is still undergoing a shakeup after Trump fired the previous BLS commissioner – and the White House just pulled their replacement nominee, EJ Antoni.

Markets are pressuring the Fed to continue cutting rates into the end of the year. The CME FedWatch tool currently has a 100% chance of a 25 basis point cut in October, with a 78% chance of another cut in December.

We will still get other economic data, including other labor reports. The ADP employment report came in below expectations this morning at -32,000 versus expectations of +50,000, which is reflective of deteriorating jobs data. It also conducted preliminary annual recalibration that showed a loss of 43,000 jobs in September vs pre-benchmarked data.

However, another of the Fed’s preferred inflation gauges, the CPI report, will likely be delayed. Investors and economists alike will have to see whether the Fed is forced to pause here, or sticks to expectations.

Morning Minute

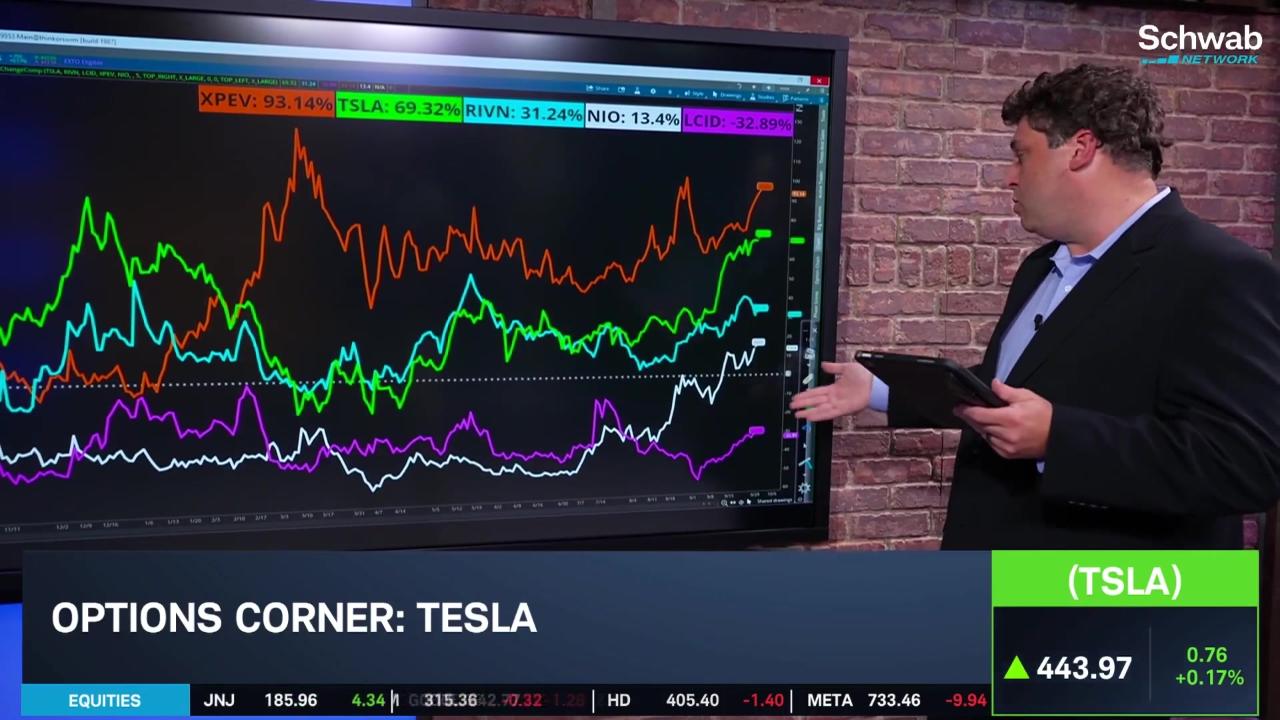

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.