- Market Minute

- Posts

- Is the Silver Trade Over?

Is the Silver Trade Over?

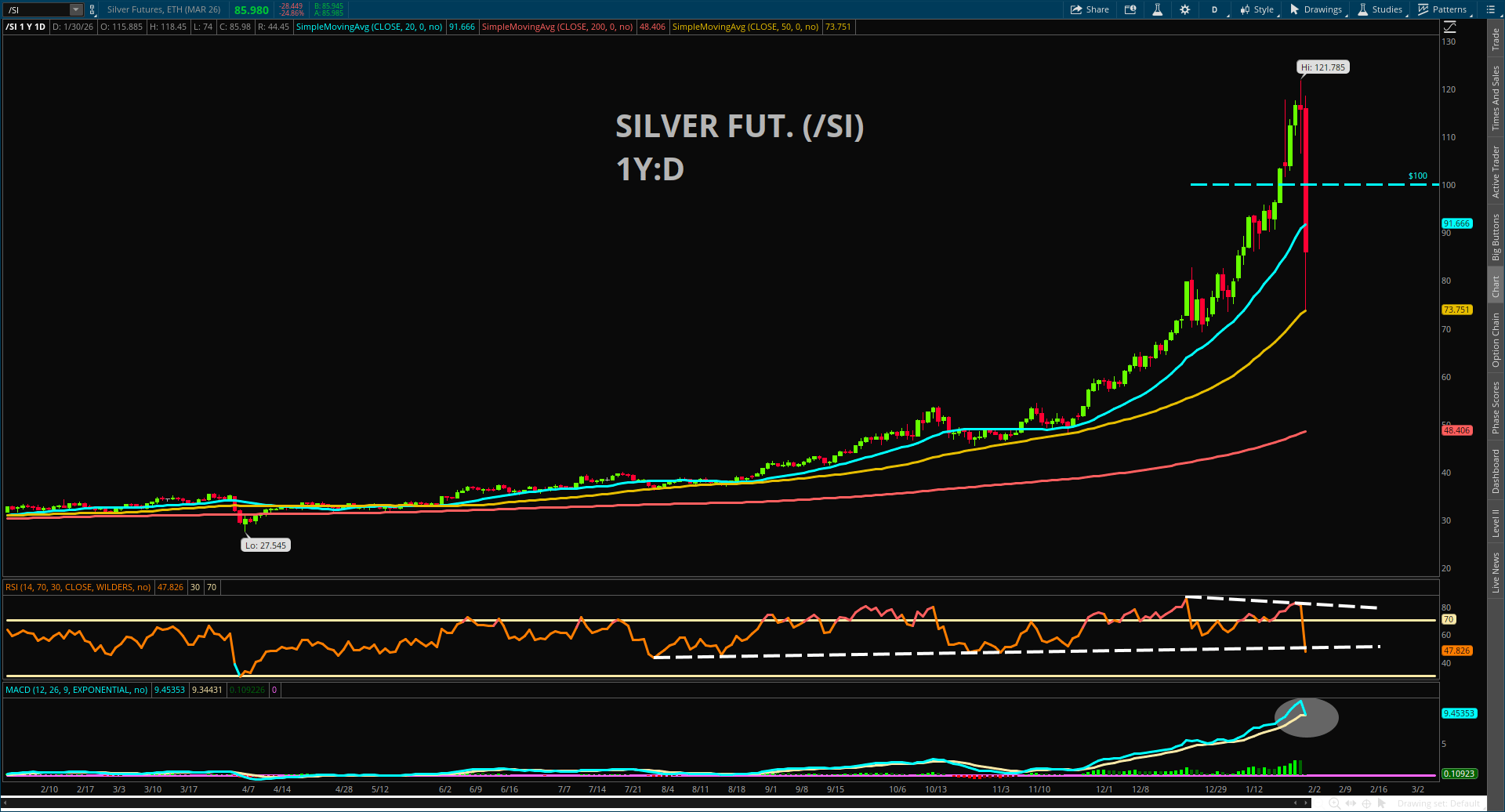

What we witnessed in the silver market last week was nothing short of a textbook blow-off-top scenario—complete with all the ingredients needed for the violent reversal we saw on Friday.

First and foremost, volatility, which was already elevated, accelerated sharply at the start of the week. Next, trading volume surged. On Monday, the March silver futures contract recorded more than 312,000 contracts traded, marking the largest volume spike since August 11, 2022. On that day, silver experienced an intraday swing of roughly 16%, which ultimately marked the beginning of a consolidation phase and the eventual breakdown in that cycle.

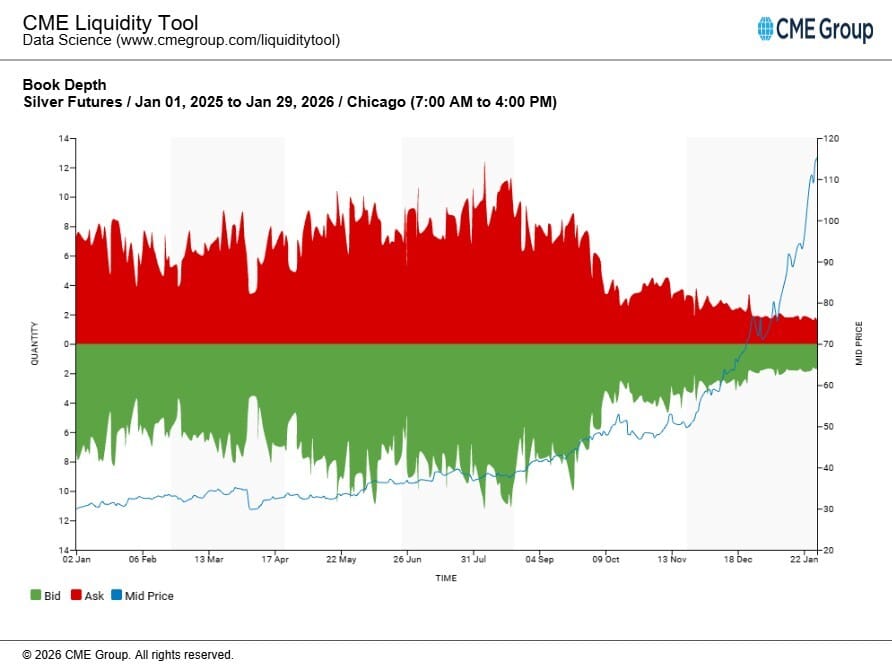

Finally, liquidity conditions deteriorated. Thin liquidity tends to amplify volatility, creating the conditions for extreme price fluctuations, and that is exactly what played out.

Even before Friday’s selloff, several indicators suggested that a meaningful pullback was approaching. One of the most notable was the steady outflow of capital from the iShares Silver Trust (SLV), an ETF that tracks silver bullion. Between January 10th and January 29th, more than $2.63 billion flowed out of the fund according to ETF.com, excluding Friday’s distribution.

Historically, near-term tops in metals often form when both retail and institutional investors begin to take profits. Once that process starts, it becomes difficult to sustain elevated prices without a fresh fundamental catalyst, either from the demand side or the supply side.

Importantly, the fundamental backdrop for silver over the past several months has remained strong. AI-driven demand and infrastructure buildouts, particularly in China, have absorbed available supply, while mining companies continue to struggle with operational constraints and production challenges across multiple ores. These factors have contributed to persistent supply tightness in the broader metals complex.

Against that backdrop, the recent pullback should be viewed less as a structural breakdown and more as a healthy reset. From a technical standpoint, a retracement bounce following Friday’s aggressive selling pressure is entirely plausible. Silver briefly touched its 50-day moving average—almost to the penny—a level that has historically acted as a key area of support during previous pullbacks.

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.