- Market Minute

- Posts

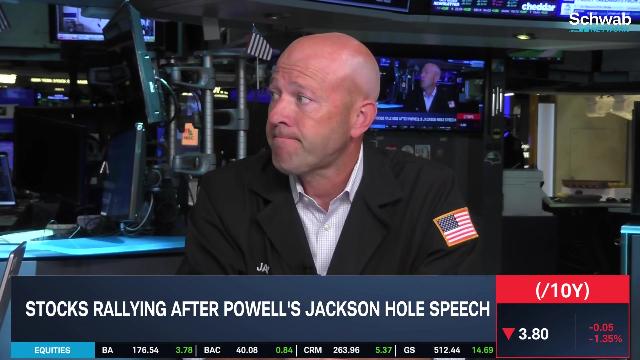

- Market Minute: Bear Season in Jackson Hole

Market Minute: Bear Season in Jackson Hole

The word is out from Fed Chair Jerome Powell in Jackson Hole: it’s open season on bears. Mr. Powell gave the most colorful, borderline joyous speech we’ve heard, with jokes, confidence, and a wink and a nod to those who doubted inflation was transitory or that his policy had the efficacy to stamp it out.

In other words, it was about as close to a victory lap as he’ll allow. There is some irony in this, given the whole reason we got here is through significant weakening in the economy. As Powell made clear, the risks are now to the downside in the labor market, as opposed to the upside in inflation. The man sounds ready to pull the lever in September, and given his description of “ample” room to adjust rates, if the data weaken significantly, it seems like a 50bps cut could be in the works.

As long as the economy doesn’t go into a tailspin, all this adds up to an effective checkmate against stock bears like David Rosenberg, who I interviewed on Market Overtime this week. There’s certainly risk of big volatility spikes like we got to start this month, but the 20-40% decline that Rosenberg told me it would take to get him buying looks like the mother of all longshots.

That said, the market is still in a precarious place. With small-caps leading alongside low-quality cyclical companies, stocks are trading like we already went through a recession and are coming out the other side – i.e., early cycle, or some kind of mid-cycle refresh. That doesn’t seem impossible with the Fed threading the needle, but the rise in unemployment and yield curve un-inversion are as reliable as late/end-cycle indicators get. Stocks seem to say early cycle, while the data point to late cycle. That’s likely to create some serious tension around basically each major data point going forward.

Market Overtime

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.