- Market Minute

- Posts

- Market Minute: Bulls Need a Follow-Through Week

Market Minute: Bulls Need a Follow-Through Week

Equity bulls have managed to turn the tables somewhat, with the S&P 500 up approximately 14% from its recent lows. Softer commentary from the White House last week and resilient earnings results so far have helped support the rally, keeping buyers engaged. However, this week is critical for the bulls to maintain momentum and continue squeezing shorts out of the market.

A heavy slate of economic data — especially labor market indicators — could have a major impact across asset classes. Meanwhile, earnings reports from Microsoft (MSFT), Meta Platforms (META), Amazon (AMZN), and Apple (AAPL) will provide key insights into the health of the economy, the effects of tariffs on consumers, and the potential impact on the AI trade. Technically, the S&P 500 is pressing against major resistance, and a modest pullback after an initial advance early in the week is something traders should have on their radar.

From a macroeconomic standpoint, the data flow ramps up starting Tuesday with the Conference Board's Consumer Confidence report and the Job Openings and Labor Turnover Survey (JOLTS). It’s not surprising that soft data such as Consumer Confidence has reflected growing concern among consumers and purchasing managers regarding tariffs and broader economic uncertainty. The question this week is whether the market will continue to emphasize soft data or begin to shift its focus more toward hard data. The JOLTS report, while important, may be viewed as somewhat stale since it reflects conditions prior to Liberation Day.

On Wednesday, the first release of 1Q Advance GDP will take center stage. Estimates are wide, ranging from a potential contraction to a slight positive print, meaning it could be a major market mover. Also on Wednesday, the PCE inflation report will be released, with consensus expecting core PCE to rise just 0.1% month-over-month. The week wraps up with the April Non-Farm Payrolls report on Friday. The market is currently expecting a net gain of approximately 129,000 jobs, with 125,000 of those coming from the private sector — both figures dramatically lower than last month’s prints.

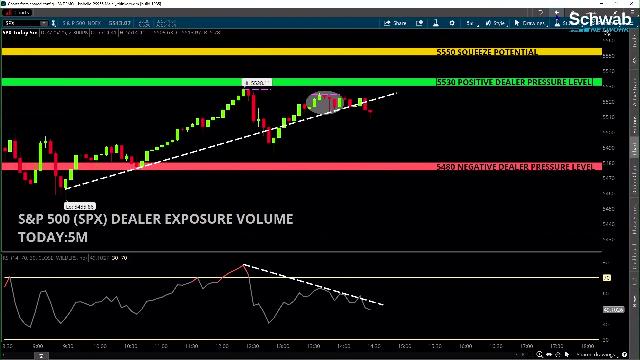

Technically, the S&P 500 is still about 2.6% below its level prior to the April 2nd Liberation Day announcement. Although the index has logged sizable gains over the past two weeks, it has yet to make a higher high on the daily chart. Volatility, as measured by the VIX, has declined from its elevated levels, but the VIX futures curve remains in backwardation — signaling that near-term uncertainty persists. Given the dense calendar of economic data and earnings events this week, the market is clearly facing a "make or break" moment.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.