- Market Minute

- Posts

- Market Minute: Equities Higher After Federal Court Blocks Broad Trump Tariffs

Market Minute: Equities Higher After Federal Court Blocks Broad Trump Tariffs

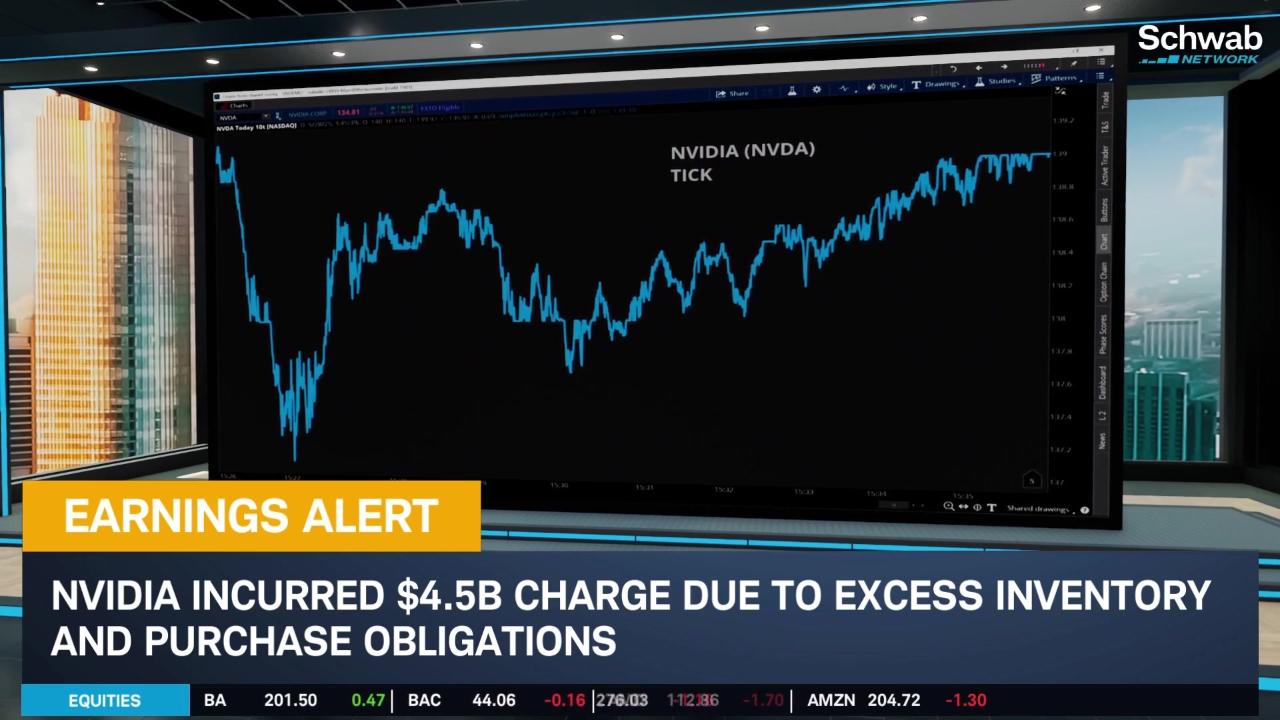

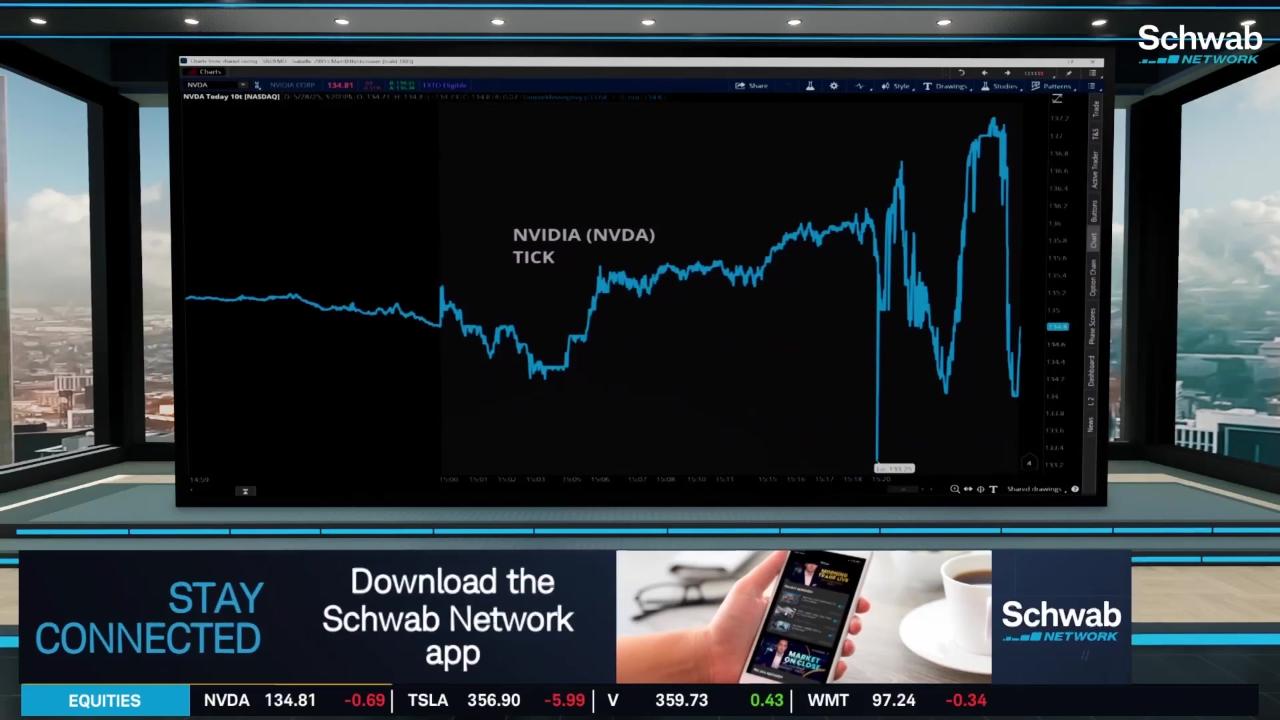

The Trade War saga got another surprise twist this morning as the U.S. Court of International Trade ruled that President Trump does not have the authority to institute all of the broad global tariffs that have so thoroughly roiled markets in recent weeks. Equity index futures are higher in early trading after the news, with S&P 500 futures up about 0.9% and Nasdaq 100 futures up about +1.4%. Traders already had a busy day on the docket, as they now must not only assess this blockbuster tariff news but also Nvidia’s (NVDA) earnings beat and two major pieces of economic data including Jobless Claims and GDP.

The federal court’s ruling came after several lawsuits argued that President Trump overstepped his authority by imposing the “Liberation Day” protective tariffs on imported goods and inappropriately invoked the International Emergency Economic Powers Act to institute them under the justification that the U.S. trade deficits amount to a national emergency. The court stated that they were not passing judgment on whether the tariffs were appropriate or would be effective, but rather that they were not allowed to be put forth under federal law.

The ruling immediately invalidates all the tariff orders that were passed using the IEEPA and that Trump must now issue new orders to reflect the ruling within 10 days. Other industry-specific tariffs that were issued on automobiles, steel, and other products using different statutes were not affected. The Trump administration already filed to appeal the ruling.

This situation now raises many important new questions that could have significant effects on markets. Will this ruling even hold up if it is appealed? What affect will this have on the Trump administration’s negotiation with other countries during the Trade War wrangling? Will the U.S. have to refund the nearly $14B in tariffs already collected (according to MarketWatch) through April 30? For now, though, markets are holding on as this holiday-shortened week approaches its close.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.