- Market Minute

- Posts

- Market Minute: Federal Reserve Holds Rates Steady Amid Economic Uncertainty

Market Minute: Federal Reserve Holds Rates Steady Amid Economic Uncertainty

The Federal Reserve’s latest policy decision to maintain interest rates at 4.5% underscores a cautious approach amid heightened economic uncertainty. Chair Jerome Powell emphasized the Fed’s data-dependent stance, acknowledging risks from inflation, unemployment, and ongoing trade tensions. While markets had anticipated potential rate cuts later in the year, Powell’s remarks suggest a more restrained outlook, dampening expectations for aggressive monetary easing.

Powell reinforced the Fed’s commitment to balancing inflation control with economic growth. He acknowledged that while the U.S. economy remains on solid footing, uncertainty from trade tariff has increased. Powell stressed that premature policy adjustments could prove costly, indicating a preference for patience over preemptive action.

Bond markets also face headwinds. Long-term yields may rise if inflation fears persist, pressuring bond prices. The Fed’s reluctance to commit to cuts introduces volatility, as investors weigh the risks of stagflation which is a scenario where inflation remains high even as growth slows.

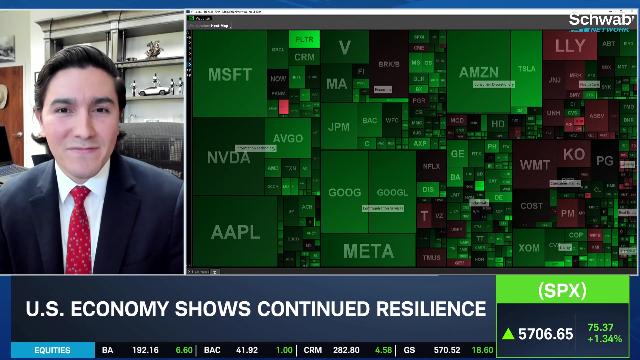

Despite the Fed’s cautious stance, equities have shown resilience in recent weeks. However, sector relative performance still reveals caution. Utilities and consumer staples have led gains in 2025, up 6.6% and 4.1% year-to-date, respectively. In contrast, consumer discretionary stocks have slumped by 10%, reflecting concerns over reduced spending on non-essential goods amid higher tariffs.

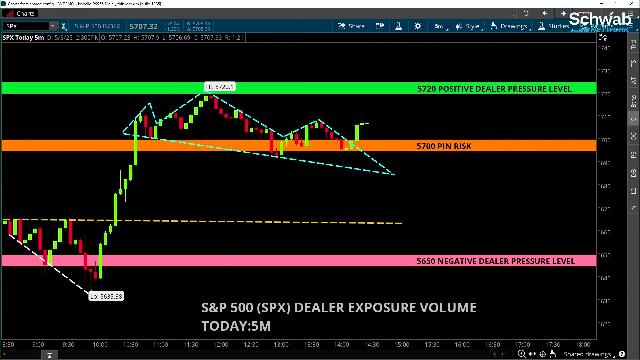

This defensive rotation suggests investors are bracing for economic turbulence. The S&P 500 remains down 3.3% for the year, though it has recovered significantly from April’s lows. Whether this rebound sustains depends on trade developments and corporate earnings resilience.

In the near term, markets will likely remain reactive to trade developments and macroeconomic data. While the Fed has left the door open for future adjustments, its cautious stance signals that investors should temper expectations for rapid rate cuts. The path ahead hinges on whether economic conditions deteriorate enough to warrant easing or if inflationary pressures force the Fed to hold firm.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.