- Market Minute

- Posts

- Market Minute: Gradual Rate Cuts Match a Resilient Economy

Market Minute: Gradual Rate Cuts Match a Resilient Economy

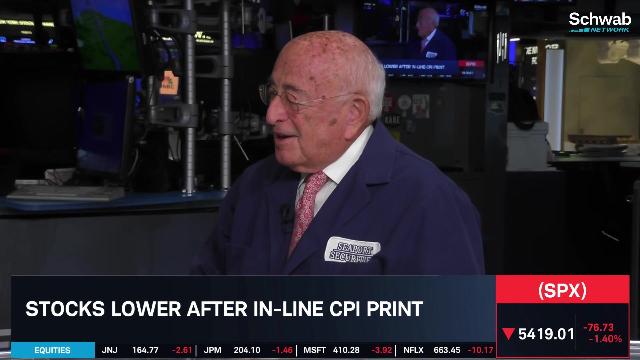

Equities closed higher yesterday after a meaningful reversal erased the early declines which started the trading day. The final CPI reading before next week’s Fed’s meeting illustrated mixed results, with headline and core CPI growth mostly in line with expectations. Headline inflation fell to 2.5% in August, compared with July’s 2.9% pace, and was slightly below the estimate of 2.6%. Durable goods prices dropped along with energy while food prices remained roughly stable.

One exception is core services inflation which remains elevated and reaccelerated for the second month in a row in August, to 4.9% on an annualized basis. Core services make up about 65% of the CPI and include housing, healthcare, and insurance. With core CPI rising at its fastest pace in four months and economic activity indicators still painting a mixed picture of the economy, policymakers may find it tough to justify a sizeable half-point reduction in the policy rate.

In a nutshell, inflation continues to trend marginally lower, setting the stage for the Fed to begin cutting its policy rate next week by 25 basis points. We can ascribe yesterday’s bullish reversal to the notion that a gradual reduction in interest rates removes the sense of urgency associated with an economy that is weakening faster than previously anticipated. The economy is slowing, yet still growing, and cutting rates too quickly runs the risk of another bout of inflation. Since markets follow the path of the economy, resilience in the economy minimizes the need for rapid rate cuts, which can be interpreted as bullish for equities.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.