- Market Minute

- Posts

- Market Minute: Market Gears Up for Tech Earnings

Market Minute: Market Gears Up for Tech Earnings

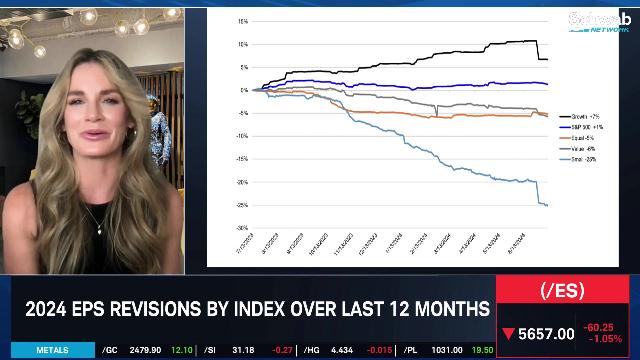

Earnings season is now officially underway, and the market has established some odd footing ahead of major tech earnings next week. Beginning Thursday of last week, a jarring and vast reversal out of the high-growth, high-volatility names began, as evidenced by the stark divergence between the Nasdaq-100 and Russell 2000 price performance on the session. Many of the names that have underperformed all year caught a bid, and the heavyweights ($NVDA, $META, $GOOGL, $MSFT, $AMD) all rather rapidly dropped on the day. Street commentators have said this was imminent, especially when so much of the market has been carried by so few players. Fast forward to Wednesday’s session, much of the overall market pressure was attributed to the sell-off in semiconductors. The “Magnificent 7” lost over $500B in market cap in one single session, with Nvidia alone shedding about $180B.

For the second quarter earnings period, S&P 500 earnings are expected to rise about 8% from a year ago on 4.5% revenue growth. That would mark the highest earnings growth rate since the 9.9% rate posted back in 1Q22.

Notably within the index, earnings growth for the energy sector is anticipated to turn positive in 2Q after being stuck in negative territory for the last four quarters. The Mag 7 stocks are expected to witness 25.5% earnings growth Y/Y on roughly +13% gains in revenues. Excluding the Mag 7 trade, 2Q earnings growth for the rest of the index drops to +4.3% from +8%. When the artificial intelligence narrative is strong, the market’s reliability on these companies is favorable to any bull. However, supply chain snags, geopolitical tensions, regulatory concerns, and heightened materials costs are all considerable factors that could reverse 2024’s steady churn to the upside (so far).

Today, Netflix’s (NFLX) 2Q financials are due out this afternoon. Next week, $GOOGL and $TSLA will report on Tuesday after the close, with $MSFT reporting the following Tuesday afternoon followed by $META on Wednesday, July 31, and both $AMZN and $AAPL releasing on August 1.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.