- Market Minute

- Posts

- Market Minute: Markets on Edge as Fiscal Expansion Collides with Bond Market Reality

Market Minute: Markets on Edge as Fiscal Expansion Collides with Bond Market Reality

As the trading week draws to a close, financial markets appear more anxious than not after several days of turbulence. Stock futures indicate a lower open following yesterday’s late-day selloff that erased most of the day’s gains. Treasury yields have retreated slightly from recent highs, and gold is poised for its strongest weekly gain in over a month, which is a telling sign of lingering investor unease.

Beneath this surface deeper anxieties persist with regards to Federal fiscal sustainability. A sweeping fiscal package narrowly passed the House of Representatives, setting the stage for a Senate battle. President Trump’s so-called "Big, Beautiful Bill" (BBB) promises to extend and expand tax cuts while increasing government spending, a combination that, according to the Joint Committee on Taxation, could add up to $3.8 trillion to the federal deficit over the next decade.

The bond market recently responded with a resounding vote of no-confidence. One indication of distress came from a poorly received $16 billion auction of 20-year Treasury bonds. Weak demand forced yields above 5%, their highest level since late 2023. This auction may be more than just a routine market event. Perhaps it is a ballot on U.S. fiscal sustainability. When foreign investors and primary dealers hesitate to purchase government debt, yields must rise to attract them, and the implications advance across the economy.

Despite recovering quickly off the April lows, equities face a dual threat from higher discount rates and weakening earnings prospects form tariffs. Aside from weighing significantly on the rate of economic growth, which slows corporate profit growth, stock valuations are likely to also come under pressure from rising yields. The S&P 500 currently trades at about 22 times forward earnings, implying an earnings yield of roughly 4.5%. With the 10-year Treasury yield now surpassing that threshold, the risk-free alternative suddenly looks more attractive than stocks, as the relative risk-adjusted opportunity cost of holding stocks rises. Historically, when bond yields eclipse equity earnings yields, market multiples contract.

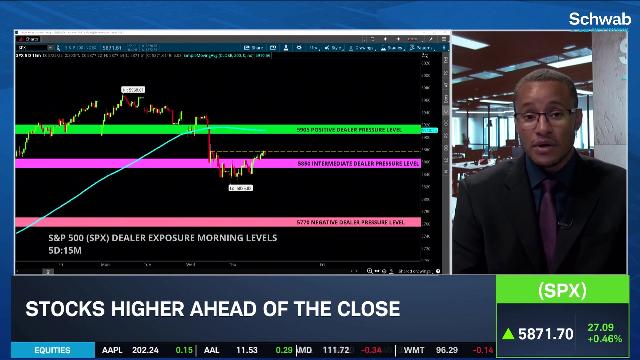

Taking into consideration technical levels, tariff and fiscal uncertainty, equity markets are at an inflection point. Regardless of the nearly 6-month wild ride since the November election, it’s hard to reconcile that the S&P 500 is at nearly the same level today.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.