- Market Minute

- Posts

- Market Minute: Nvidia Earnings and What’s Next

Market Minute: Nvidia Earnings and What’s Next

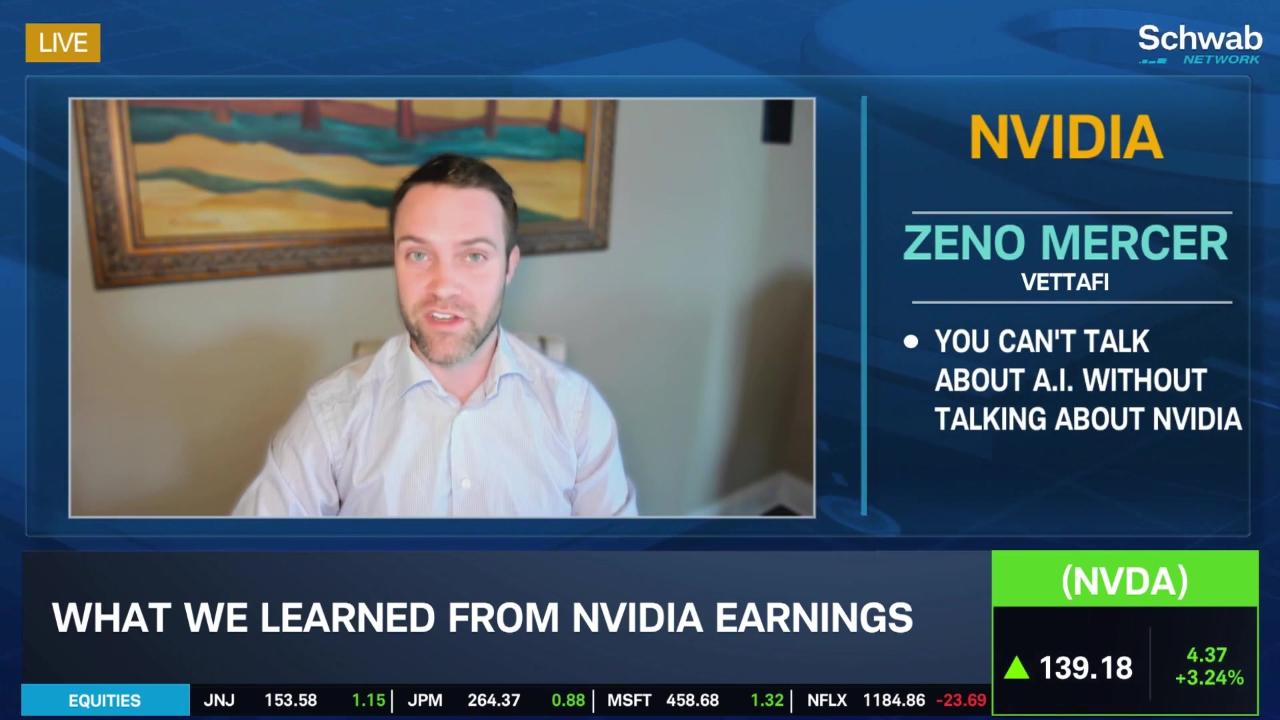

Nvidia (NVDA) reported 1Q26 this week, posting revenue of $44.1 billion (+69% year-over-year) and EPS of $0.81 (+33% year-over-year). However, EPS missed Street estimates for the first time in nine quarters. The stock rallied after the report and is up 19% over the last year, though only around 1% year-to-date.

Data center revenue made up most of Nvidia’s sales, coming in at $39.1 billion (+73% year-over-year) and reflecting continued strong demand for its chips. On the other hand, the company posted a $4.5 billion charge, citing excess H20 inventory because of export controls banning it from selling those chips in China.

Jensen Huang, CEO, also announced that their “breakthrough” Blackwell supercomputer, a “’thinking machine’ designed for reasoning,” is now in full-scale production. It is also partnering with Dell (DELL) to build a supercomputer for the Department of Energy.

Nvidia is clearly the leader on the hardware side for these high-tech chips, but that $4.5 billion charge hangs over it. Whether or not the export controls against China remain, it shows that hardware sales are, in some ways, limited, whether through production capacity or political tensions. It’s looking to capture some of the software side of its breakthrough inventions through a major investment.

CoreWeave Investment

CoreWeave (CRWV) is a fledgling AI cloud computing company. It IPO’d on March 28 of this year and has run up since then – it made a new all-time high in Thursday’s trading at $130.76. For context, it’s up over 150% just this month. It likely saw a boost from NVDA earnings.

Founded in 2017, CoreWeave initially was a cryptocurrency miner before pivoting to AI, where it’s made a spectacular splash. A testimonial on its website from Sam Altman, CEO of OpenAI, calls it “one of our earliest and largest compute partners.” Clients even include financial firms like Jane Street.

“AI workloads are different… [using] matrix-based calculations that are computationally intensive,” CoreWeave’s cofounder Brannin McBee said – meaning that AI computing infrastructure has to be built from the ground up.

That infrastructure is the key: CoreWeave’s AI cloud offerings come from building their own data centers for those complex workloads. This requires a lot of design and engineering expertise, as well as the highly-in-demand Nvidia chips.

Nvidia backed the company before it became public, to the tune of $900 million worth of shares. In fact, CNBC reported that it offered to anchor the IPO at $40/share with a $250 million order. Nvidia filings show that at the end of March, it owned 24.2 million shares of CRWV, or a 7% stake in the company. The Street notes that CRWV is Nvidia’s largest holding, “making up more than 78%” of its disclosed portfolio.

So, Nvidia is making a big bet on this particular cloud computing offering. In fact, since 2023, CoreWeave has provided Nvidia with infrastructure and platform services, per Barron’s.

As AI proves itself more and more in various fields, cloud demand will grow – and Nvidia is poised to benefit on both sides of the equation. However, the arms race around the world over AI will continue, and we’ll have to see what comes next.

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.