- Market Minute

- Posts

- Market Minute: Post Election Market Melt Up is Normalizing

Market Minute: Post Election Market Melt Up is Normalizing

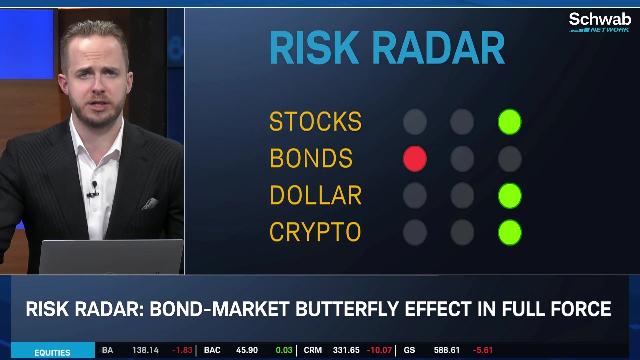

The animal spirits of the post-election melt up in stocks have seemingly subsided for now, much like the reflation trade following the results of the 2016 Trump victory. Markets may continue to take a watchful tone going forward, seeing as heightened inflation risks and policy uncertainty might induce elevated volatility going into the end of the year. The U.S. dollar touched its strongest level in six months yesterday, and cyclicals such as materials and industrials, as well as broader semiconductors, had a noticeable pull back in the past couple of days.

The October CPI report this week was a mixed bag as headline inflation ticked up to 2.6%. This was in line with consensus expectations. However, core inflation, which better reflects inflation’s underlying trend, was up 3.3% year over year and up from 3.25% in the previous month. Inflation has declined markedly since the middle of 2023, but the slowdown in the rate of change in price growth has been asymmetrical. The rolling three-month average of inflation has risen higher, and the bond market may reflect this underlying trend whereby progress against inflation has seemingly stalled. Treasury yields jumped sharply higher on Tuesday as investors focused on the risk of a resurgence in inflation during a second Trump presidency. The yield on the 10-year Treasury continues to hover close to the highs near 4.5% after last week’s election. This yield was at 3.6% before the Fed's September 50-basis point cut and has been rising since then. The two-year yield has also risen to 4.35%, reflecting higher short-term interest rate expectations.

As such, investors have recently scaled back their expectations for how quickly the Federal Reserve will cut interest rates. Fed Chair Jerome Powell confirmed yesterday there is no need to rush rate cuts with the economy still growing, the job market solid, and inflation still above the 2% target since. Hence, according to data from the CME Group, the probability of a December rate cut now stands near 60%. This is a meaningful decrease in rate cut expectations, which stood at nearly 85% earlier this week.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.