- Market Minute

- Posts

- Market Minute: Prep for the Week

Market Minute: Prep for the Week

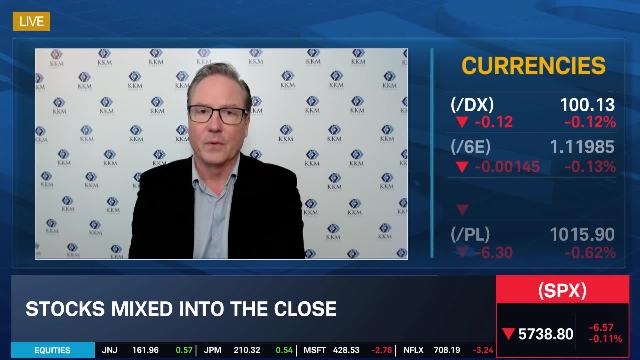

The S&P 500 continued its rally last week, driven by optimism around the Fed's interest rate policy and encouraging economic data. However, brace for increased volatility this week. For the past two months, weeks that featured extensive labor data and ISM manufacturing figures have rattled markets. This week is no different, with JOLTs, ADP Non-farm Payrolls, and the monthly Jobs Report all due by Friday, raising questions about the strength of the labor market.

ISM manufacturing data has also been a consistent source of disappointment, reflecting a contracting industrial sector. Sentiment indicators show weak new orders, a critical gauge for growth momentum, while ISM prices have accelerated over the last two readings, signaling rising input costs. Investors should be prepared for potential market swings as these economic data points are digested, and keep an eye on the upcoming earnings season, which kicks off next week on Friday, led by major financial institutions like JPMorgan (JPM) and Wells Fargo (WFC).

Meanwhile, an unexpected stimulus boost from China has driven a significant rally in stocks with high China exposure, such as Wynn Resorts (WYNN), Nike (NKE), and BHP Group (BHP). The key question now is whether this rally is sustainable, and what indicators might signal that the Chinese stimulus is having its intended effect. Notably, much of the recent gains in China have come from technology and internet stocks.

To assess the durability of this rally, pay close attention to industrial metals like copper and silver, as well as trade and agricultural data. The USDA's weekly Export Sales Report, copper inventory levels in Shanghai, and import figures for staples like soybeans or soybean meal will offer valuable insights. Additionally, stronger-than-expected petroleum imports over the next three to four months would indicate that stimulus measures are taking hold. Conversely, any reversal in commodity trends—particularly for silver, copper, or a lack of a significant uptick in oil prices—should raise doubts about the long-term sustainability of the rally. For now, caution is warranted when it comes to the China trade until there is clear evidence of economic traction.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.