- Market Minute

- Posts

- Market Minute: It’s Probably Too Late for Rotation

Market Minute: It’s Probably Too Late for Rotation

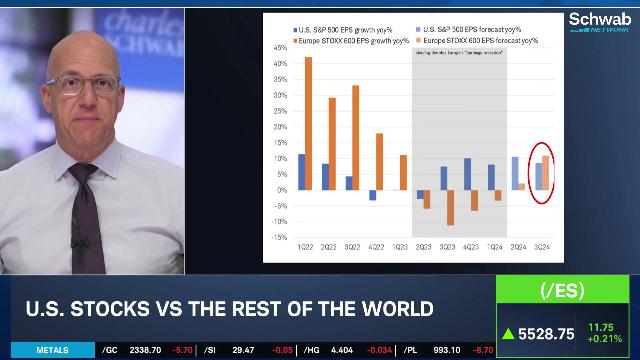

Yellow flags have been cropping up across the stock market for more than a week. On June 14, I changed my green light to yellow for stocks on my Risk Radar because the economic data were softening rather rapidly, and the runup in A.I.-linked megacaps was due more to valuation expansion than earnings revisions. Now, with Nvidia (NVDA) cracking a bit for the first time since first-quarter earnings, investors are wondering if the market will find new leaders and rotate into other themes.

I doubt it. The S&P 500 index probably remains a do-or-die A.I. trade for the time being.

First, the charts just don’t look good for non-tech themes. The S&P equal-weight index (SPXEW), despite a few good days the past week, looks much more in a pattern of consolidation as opposed to breakout. And some economically-sensitive groups like regional banks and homebuilders look like they could roll over at any moment. The small-caps, of course, just can’t seem to get anything started for basically a year now.

A rotation into more cyclical groups would require one of two things: a revival in the economy, or new support by policymakers. Neither look promising right now. Economic data are missing by the worst margin all year, but elevated inflation means the Federal Reserve will be unable to cut rates earlier than September, at best. That’s at least a two-month window without much macro support for what would need to be a macro trade into lower-quality companies that aren’t currently generating much growth.

Signals from the crypto market also point toward waning risk-appetite. Bitcoin hasn’t been able to keep up with stocks for months and is now testing key support to the downside. If there’s one thing the asset class is good for, it’s as a barometer for animal spirits and risk-taking sentiment. If it cracks through $60,000, it’s more likely to be part of a higher-correlation selloff in risk assets than a standalone event in the midst of a rotation.

There is one key thing on the calendar that could spur rotation or better breadth in general: the U.S. Presidential election, which is sure to elicit some big fiscal promises from the candidates. But so far, it’s been more mud-slinging than economic talk. Unless there’s some truly shocking drop off in inflation in these next few readings, the stock market is likely still a game of Nvidia or bust.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.