- Market Minute

- Posts

- Market Minute: Weekend Spotlight on Paymentus (PAY)

Market Minute: Weekend Spotlight on Paymentus (PAY)

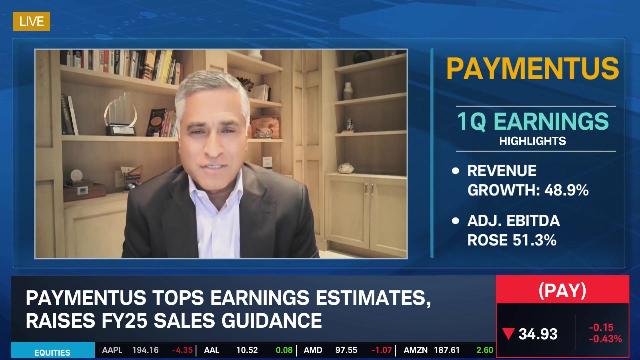

The founder and CEO of Paymentus (PAY), Dushyant Sharma, joined the Schwab Network to discuss the company. Founded in 2004, Paymentus calls itself a provider of “cloud-based bill payment technology and solutions.”

On its site, it boasts “bank level security” and allows users to pay through a variety of channels, including text, web, call centers, and even AI assistants. Its focus is being an all-in-one platform for both sides of the financial equation. In doing so, it accepts payments from all types of sources, from Visa and other credit cards, to PayPal, Amazon Pay, Google Pay, and more.

It says it serves over 2,500 billers and financial institutions, and then in turn is used by millions of consumers and businesses in North America. In 2024, it processed 597 million transactions, with “46 million consumers and businesses” using Paymentus for bills in December of that year. Its clients include utility companies, healthcare & insurance, property management, and even government agencies. They also work with small businesses.

Sharma emphasizes that they serve non-discretionary sectors, insulating it from economic slowdown. Perhaps you’ve come across it already in your daily life, whether on a monthly electricity bill or at a small business, and not even known it.

Looking at the stock itself, PAY is up 12% year-to-date as of the time of this writing, and up 90% over the last year. It has moved strongly upwards since April 7, with mostly green candles, and is only a few dollars away from an all-time high.

In its last quarter, Paymentus beat on the top and bottom line with non-GAAP EPS of $0.14 and revenue of $275.2 million (+49% year-over-year). They also increased their gross profit by 25% year-over-year and reported $41.1 million in free cash flow. They processed 173.2 million transactions in the quarter, a 28% increase from 1Q 2024. They also raised their full-year guidance.

Sharma emphasizes that they haven’t seen any impact from tariff volatility and uncertainty. He says Paymentus has a strong pipeline, bookings, and backlog, so it needs to stay “humble” and focus on execution. “We have grown 30% in market share since last year, so we are feeling great about where we are.” According to their latest shareholder’s presentation, they own 3.6% of U.S. Bill Payment Market.

Companies like Paymentus operate under the radar for many investors but make up a critical part of digital infrastructure. Without this sector, companies would have to build out their own billings systems individually. While payment companies like PayPal (PYPL) and Square (XYZ) are bigger and offer consumer-focused products like credit cards, Paymentus is focused on their platform and infrastructure. As mentioned above, they even accept payments through PayPal or Square’s systems.

Watch the full interview below:

Video Spotlight

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.