- Market Minute

- Posts

- Mutually Assured Disruption in Nuclear Supply chain

Mutually Assured Disruption in Nuclear Supply chain

This is not just another “Fed cuts 25 bps” note, but rather a significant development happening in the background that could escalate over the coming months: the potential for a dramatic shift in uranium supply lines, critical to nuclear power.

For context, uranium—particularly low-enriched and, in some cases, highly-enriched uranium—is essential for powering most nuclear reactors that generate electricity. According to the U.S. Energy Information Administration (EIA), nuclear power accounts for approximately 19% of all electricity generation in the United States. However, recent events have raised concerns about the stability of the current uranium supply chain.

Russia is the world’s largest exporter of enriched uranium, accounting for about 35% of global exports, and many Western countries depend heavily on this supply for their nuclear reactors. With the ongoing war in Ukraine and the recent large-scale Ukrainian strike on one of Russia’s largest ammunition depots in Toropets, the risk of escalating economic tensions is growing. In response to economic restrictions and the war expanding, Russian President Vladimir Putin has suggested a potential ban on certain commodity exports to Western nations, which could include uranium. This has caught many Russian companies off guard, given the potential economic impact on their operations and the country, but such a move could also put the West at serious risk.

Additionally, we must not overlook the geopolitical ripple effects from last year. Niger, the world’s seventh-largest uranium supplier, experienced a coup in July, reportedly supported by the Russian-backed private military company Wagner. This coup led to disruptions in uranium supplies to France, as operating permits for a major uranium production facility were revoked by Niger’s new “government.” This development further strengthens Russia’s leverage in the global uranium market.

As with any commodity facing perceived scarcity, disruptions in supply chains and sourcing can trigger price increases and demand spikes from end-users. Given the ongoing geopolitical tensions, uranium may emerge as one of the most significant non-kinetic levers Russia could use to exert pressure on Western countries. With very few companies and exchange trade products having exposure to this space like Cameco Corp (CCJ) or Global X’s Uranium ETF (URA) the concentration of investment flows into this industry may prove to be a benefit if further economic restrictions are enacted.

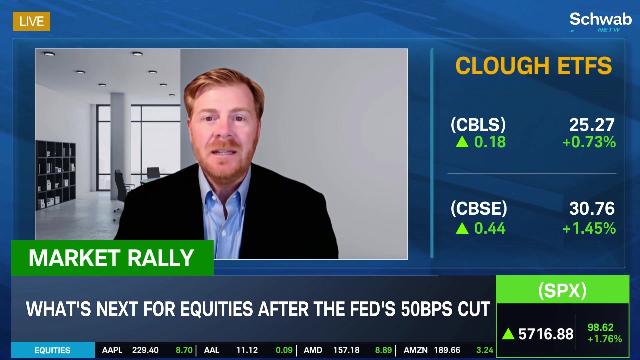

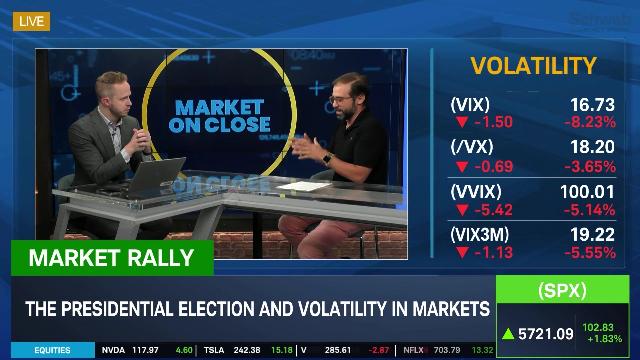

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.