- Market Minute

- Posts

- Netflix (NFLX) Slumps -4.9% After Warner Bros. (WBD) Acquisition Bid Reports

Netflix (NFLX) Slumps -4.9% After Warner Bros. (WBD) Acquisition Bid Reports

Netflix (NFLX) shares fell -4.9% yesterday after word that the streaming entertainment giant submitted its second offer in the bidding war for Warner Bros. Discovery (WBD).

Various news reports said the offer is primarily in cash for the entertainment and streaming assets of Warner Discovery, and that Netflix is preparing for tens of billions of dollars in financing for the deal. Warner owns HBO, HBO Max, Cinemax, Cartoon Network, HGTV, and has a vast number of other entertainment licenses, studios, and sports partnerships.

But there are other offers on the table from two of Netflix’s archrivals; Comcast (CMCSA) and Paramount (PSKY). Comcast, which is the owner of Xfinity, NBCUniversal, and the Peacock streaming service, also made its second offer for these same entertainment assets. However, Paramount is looking for an even bigger deal. The iconic film studio seems to be looking to expand its already formidable broadcasting empire, as it wants not only the Warner’s entertainment assets but also its cable networks such as CNN and TNT. Paramount’s assets include networks like CBS, Showtime, and MTV, as well as its own streaming services in Paramount+ and Pluto TV.

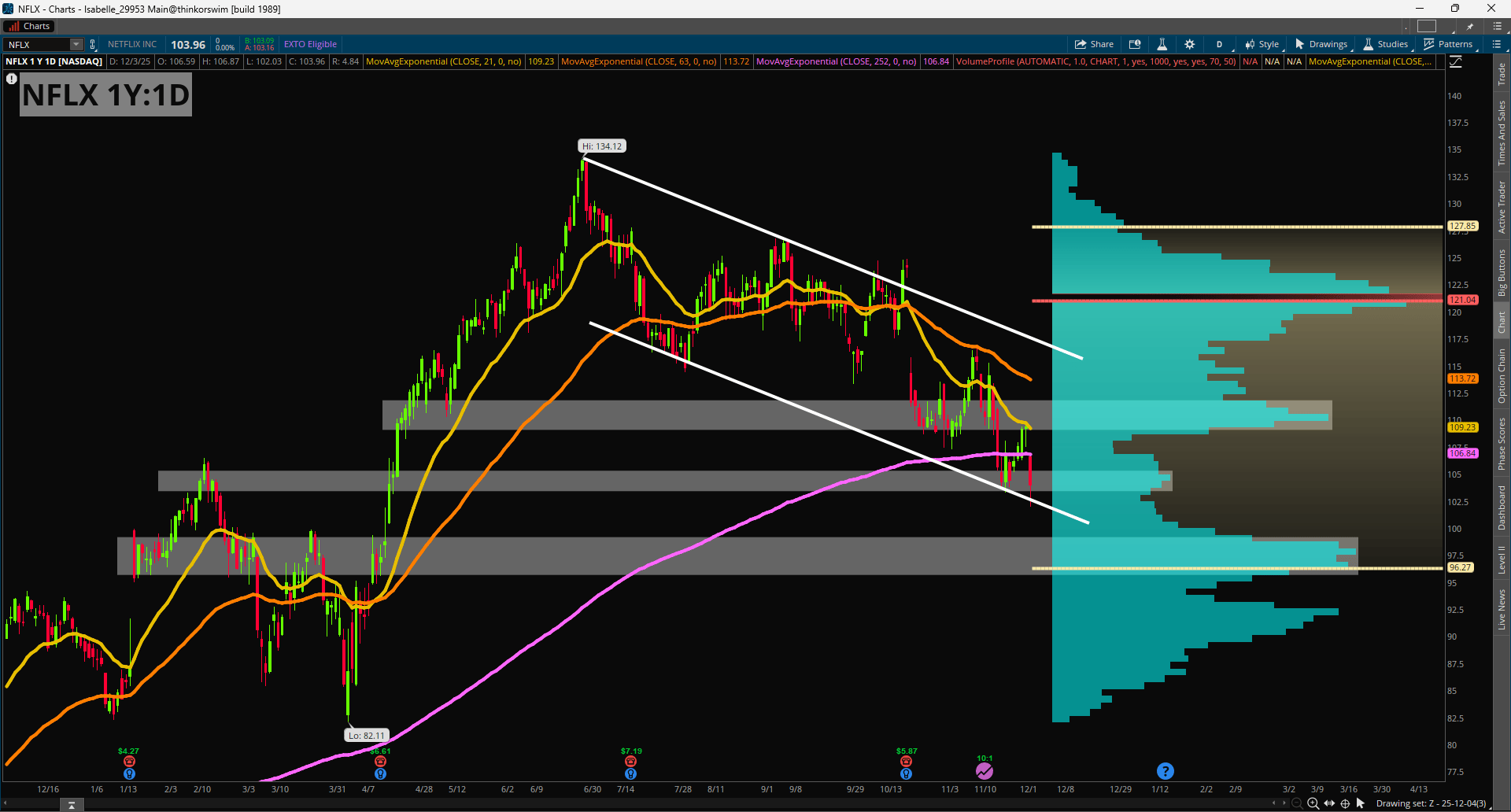

Netflix has seen a -22.5% slide since its all-time high of 134.12 on Jun. 30, with the price activity mostly contained within a downward channel-type shape. Yesterday’s slide seemed to solidify near this support area slightly under 103, but there were also some more negative technical developments. Price made a marginally worse close below the relative lows from late November even as it held on near this same level, but it also failed to retake the 63-day Exponential Moving Average on Tuesday around 109 and closed firmly below the 251-day EMA which came in just below 107 yesterday.

In terms of other studies, the RSI is compressing in a triangular range in bearish territory below the 50 midline. Traders who follow momentum likely will be on the lookout for a corresponding RSI breakout with any directional push. The yearly Volume Profile study shows a small node near this 103 level, but the trading activity is much heavier near 110 to the upside and 98 to the downside so these could also be potential consolidation areas. Meanwhile, the options market suggests a potential move of about +/-6.60 (6.4%) for the Dec. 19 expiration.

Morning Minute

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.