- Market Minute

- Posts

- Nvidia (NVDA) Earnings Preview

Nvidia (NVDA) Earnings Preview

Nvidia (NVDA) earnings are arguably the biggest market event of the week. The megacap makes up a whopping 7.4% of the S&P 500 alone (13.7% of Nasdaq-100 and 2.4% of the Dow), meaning any substantial move could roil entire indexes. The options market is implying a +/- $12 move, or a little over 6.5%.

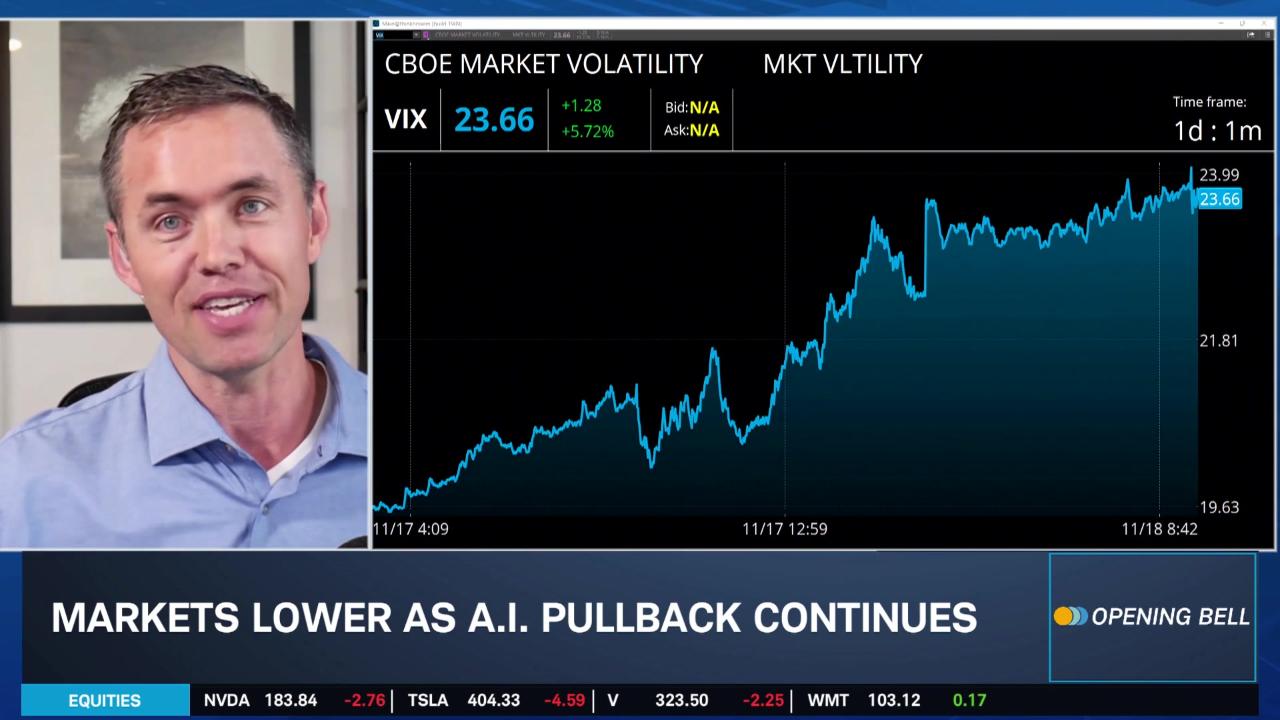

The market is starting to pull back from the tech trade a bit as fears of a bubble rise, and many are looking to Nvidia to see if those fears are realized. Zacks anticipates EPS of $1.24 (+53% vs last year) and revenue of $54.86 billion (+55% vs last year). These growth trajectories are still strong, but will markets be expecting more with the billions upon billions poured into AI capex this year?

Nvidia is also battling various restrictions, both on exports of their chips and imports of the rare earths needed to create them. Companies like Alphabet (GOOGL), OpenAI, and others have all been making huge commitments to building out AI infrastructure, but if Nvidia says it isn’t in a position to maintain supply, timelines across industries could be thrown out of whack. It will be important for investors to hear confidence from CEO Jensen Huang on the earnings call, along with strong guidance.

Several notable investors have been liquidating their stakes in the stock recently, including Peter Thiel’s hedge fund (around $100 million) and SoftBank (almost $6 billion). This isn’t just taking some gains: both sold their entire holdings. While prominent investors pulling out may worry traders, SoftBank noted that it put the money into OpenAI instead, so the AI trade is still on.

The market is beginning to wonder where AI returns are. Nvidia (NVDA) has charted incredible growth on the top and bottom line over the last few years, but the curve is beginning to level, and these capex commitments need to stabilize. Nvidia will need to prove that data center demand continues, and that it remains ahead of rivals both in innovation and fulfillment. The stock is up 27% vs last year and is up 35% year-to-date, but has been coming off highs recently.

Join the Schwab Network for extended NVDA earnings coverage after the bell today, and much more!

Morning Minute

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.