- Market Minute

- Posts

- Powell’s Pivot to Prudence: Labor, Liquidity, and the Limits of Dovish Hopes

Powell’s Pivot to Prudence: Labor, Liquidity, and the Limits of Dovish Hopes

Markets traded in a narrow uneasy range as investors digested a pivotal Fed week that paired a quarter-point cut with a surprisingly firm message from Chair Jerome Powell about the road ahead.

The headline adjustment to 3.75%–4.00% was broadly anticipated, but Powell undercut the popular “auto-cut” narrative, stressing that a December reduction is not a foregone conclusion, and anchoring that caution in how the labor market evolves over the next several weeks. He emphasized that conditions have “gradually” cooled and that policy is now “meaningfully less tight,” calibrated to avoid further deterioration in employment without declaring victory on inflation.

That framing forced traders to re-price the glidepath as still supportive for risk assets, but explicitly data-contingent and highly sensitive to any inflection in initial jobless claims, job openings, or survey evidence that hiring demand is stabilizing.

The other, arguably bigger, story was balance-sheet mechanics. The Fed said it will end aggregate runoff on December 1st and begin holding the portfolio roughly steady. Crucially, it will continue to let agency MBS roll off, but it will redirect all principal payments from those holdings into Treasury bills. Operationally, the New York Fed’s Desk will roll over all maturing Treasuries at auction and reinvest every dollar of agency principal into T-bills via secondary-market purchases.

In effect, the central bank is accelerating the multi-year migration away from mortgage credit toward short-dated government paper, arming itself with a nimbler tool to manage reserves and money-market conditions, while shrinking its mortgage footprint over time. For markets, QT’s broad drag on liquidity slows, but composition continues to shift in a way that should cheapen mortgages versus bills at the margin and, by extension, keep term premia choppy even if the balance-sheet top line stabilizes.

The balance sheet pivot directly addresses tightening money market liquidity as the burden of QT increasingly fell on bank reserves. The new reinvestment plan is designed to cap liquidity risk and give the Fed a faster mechanism to add or drain reserves as needed.

Traders noticed as front-end rates wobbled during Wednesday’s press conference and mortgage pricing widened as desks penciled in steady MBS runoff offset by bill buying. The mechanical clarity helps, but Powell’s tone kept the door wide open to pausing rate cuts if the labor data steadies or if inflation proves sticky.

By week’s end, the tape reflected this push-pull. Equities leaned on solid corporate prints but lost momentum whenever Powell’s “not a foregone conclusion” line resurfaced on screens. Rate markets faded an early dovish read as participants connected the dots between a slower balance-sheet runoff, a still-careful Fed, and fiscal cash management that continues to siphon reserves during the shutdown and tariff-collection cycle. The market wants to rally on better micro news but remains exquisitely sensitive to macro plumbing.

Morning Minute

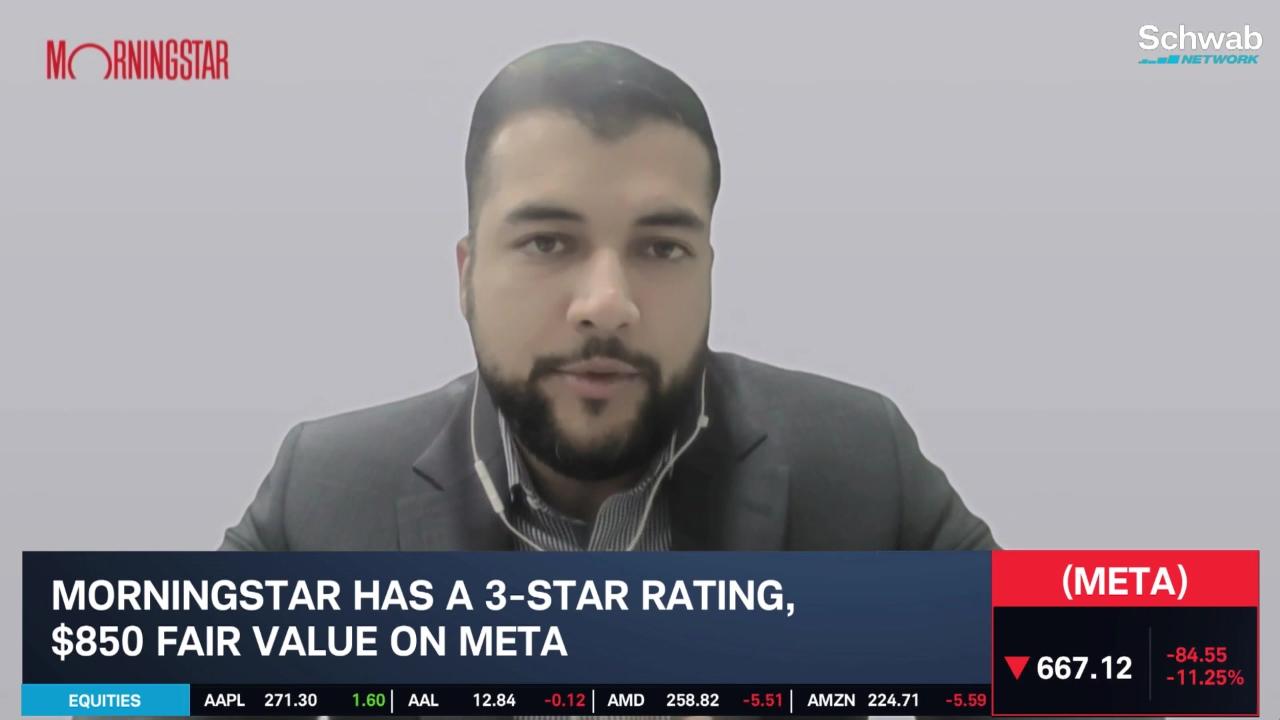

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.