- Market Minute

- Posts

- Semiconductors Back In Focus with NXPI Earnings on Monday

Semiconductors Back In Focus with NXPI Earnings on Monday

Earnings season continues Monday as computer chip makers come back into focus, with NXP Semiconductors (NXPI) reporting quarterly results in Monday’s postmarket. This could be an important bellwether for other companies in the sector slated to give earnings results later in the week, like Texas Instruments (TXN) in Tuesday’s postmarket and Intel (INTC) after Thursday’s close.

But traders hoping for some clarity on the sector with this week’s earnings from Taiwan Semiconductor (TSM) and ASML (ASML) got something of a mixed picture. On one hand, TSM shares hit new all-time highs after giving a positive outlook based on the artificial intelligence-driven technology boom – though the stock gave back some of the gains on Friday. On the other hand, ASML fell more than -8% after its own earnings, saying they couldn’t confirm they would see growth at all during 2026 and blaming macroeconomic and geopolitical uncertainty.

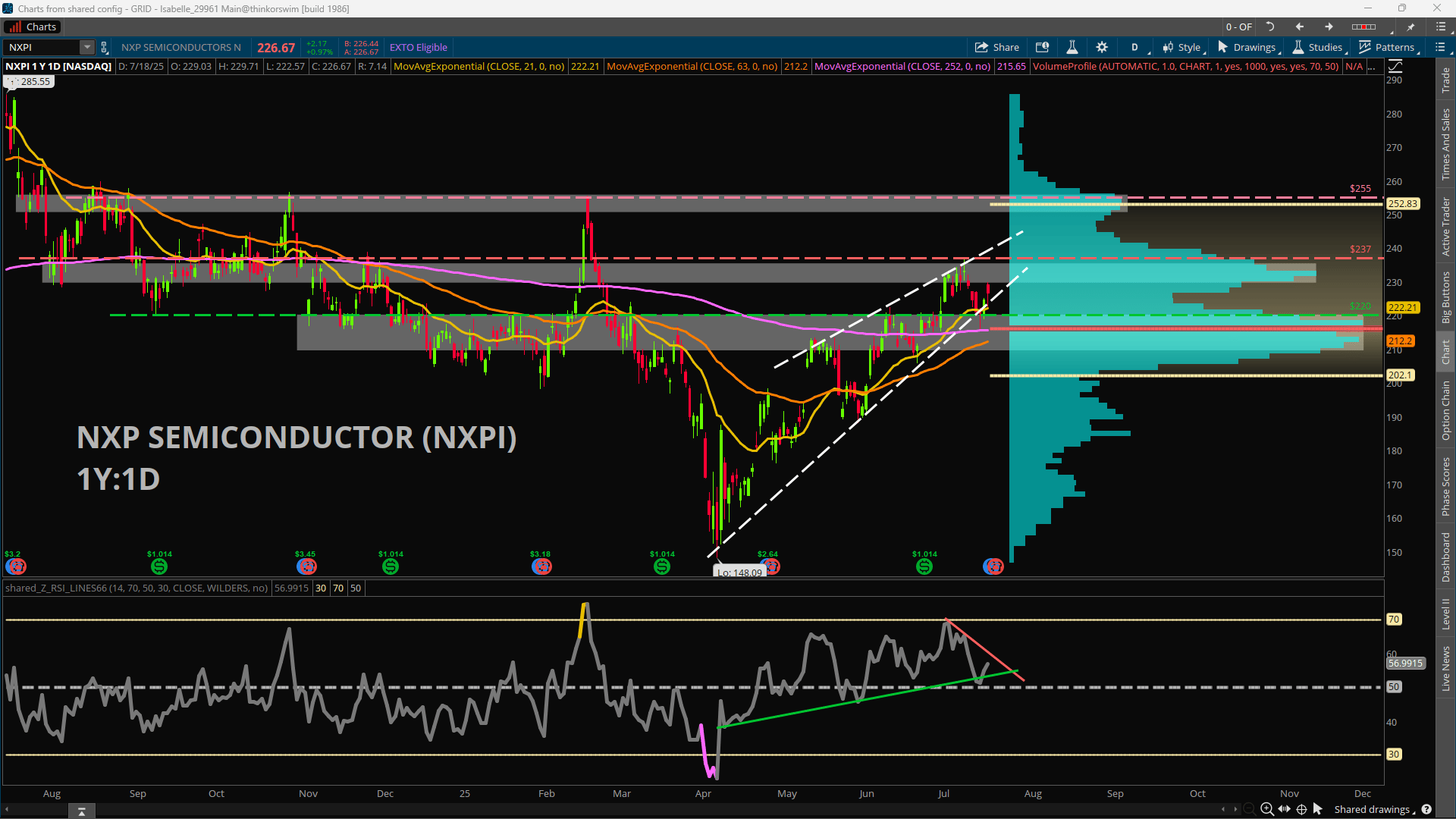

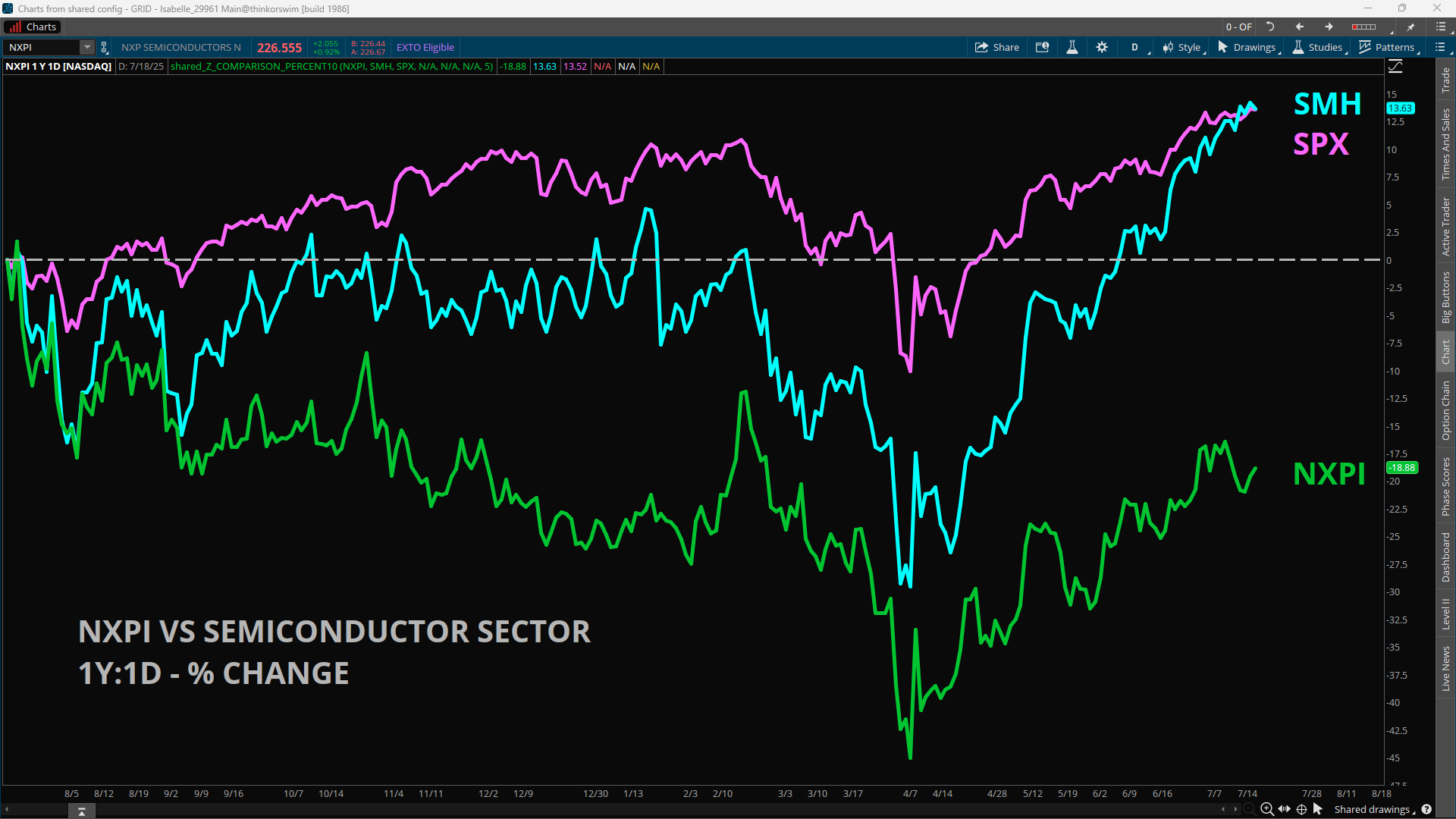

NXP, a company based in the Netherlands, focuses on microcontrollers and processors. The stock has notably underperformed its peer companies in the sector with NXPI shares down about -19% during the past 52 weeks, while the VanEck Semiconductor Index (SMH) and the broader S&P 500 index (SPX) are both up about +13%. Analyst expectations for NXPI’s earnings next week are mostly down from the previous year’s results. EPS is expected at $2.55 vs. $3.20 one year ago (almost -17% lower), while revenue estimates are for $2.90B vs. 3.13B last year (about -7% lower).

Nevertheless, a recent analyst note from Oppenheimer said they expect modest upside for NXP this quarter. Specifically, the note said they are looking for strength in NXP’s auto and industrial segments, driven by processors, radar, and battery management systems. Oppenheimer has an outperform rating on NXPI shares with a $250 price target. Meanwhile, other firms seemed bullish as well with several price target bumps in recent days, including from Stifel ($210 from $170, maintains hold), Deutsche Bank ($265 from $250, maintains buy), and TD Cowen ($217 from $210, maintains buy).

From a technical perspective, NXP has previously encountered resistance around the 237 area, most recently on July 10 as price reached the upper boundary of a rising wedge-type shape before retreating back to prior support near 220. A volume node near 235 also could present a potential slowdown area. Beyond that, 255 marks a repeated highwater mark the bulls have been unable to break. To the downside, several major moving averages, such as the 21-day, 63-day, and 252-day Exponential Moving Averages, are clustering together between about 212 to 222. This area also includes the yearly Volume Profile Point of Control at about 216, so this could be a notable supportive zone.

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.