- Market Minute

- Posts

- Stocks Enter December with Positive Momentum

Stocks Enter December with Positive Momentum

Stocks rose on Friday in holiday shortened trading and saw the major indices rise for the fifth session in a row. The S&P 500 (SPX) was up 0.54% while the Nasdaq-100 (NDX) rose 0.78%. The Dow Industrials Index ($DJI) was up 289 points or 0.61% on Friday while the small-cap Russel 2000 (RUT) rose 0.58%. Despite weakness in the tech-heavy Nasdaq-100 (NDX) in November (-1.6%), the SPX finally turned positive on the last day of the month to finish up 0.1%. The Dow Index rose 0.3% last month and the small-cap RUT was higher by 0.9%. After initial downside Volatility for the first three weeks of November, stocks staged a major rebound the final week of trading.

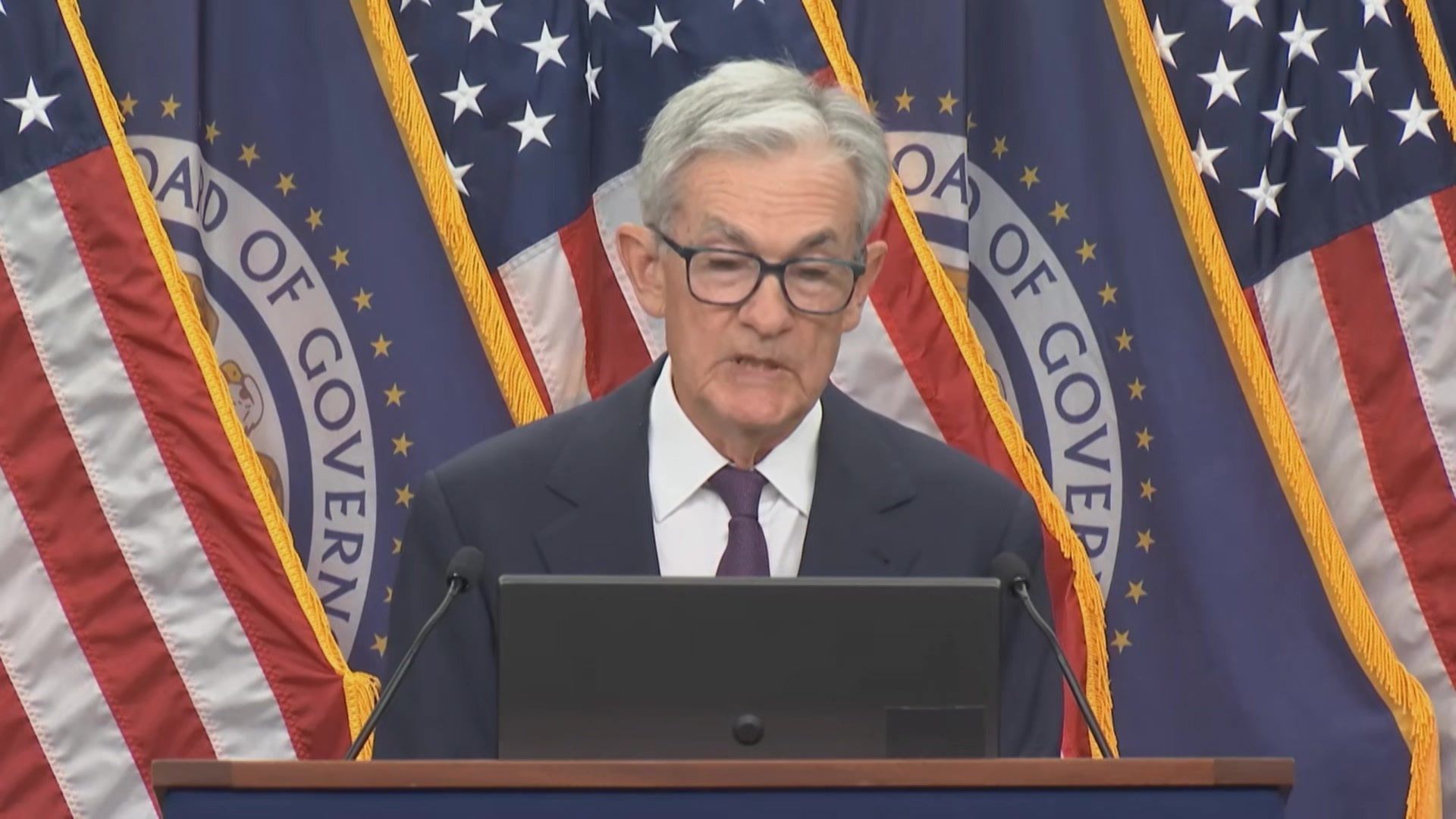

The catalysts for the rebound were rising expectations for a rate cut next week from the Fed, earnings outperformance, and optimistic investors. The primary driver for market sentiment is the shifting outlook for the Federal Reserve's monetary policy. Following comments from various Fed officials and data from the Beige Book indicating softer hiring and consumer spending, the market has rapidly increased its bets on a rate cut at the upcoming December 9-10 Federal Open Market Committee (FOMC) meeting. Traders are currently pricing in an estimated 87% chance of a quarter-point rate cut in December, a significant jump from expectations earlier in November. A rate cut, if realized, is widely expected to provide a meaningful tailwind for equities.

Investors will scrutinize several data points this week for clues on economic momentum and inflation, especially given many reports (including the official jobs report) were delayed by a recent government shutdown. Data on Black Friday and Cyber Monday consumer spending will provide an initial read on holiday retail strength, which is crucial for a consumer-driven economy. ISM manufacturing and services data will also be in focus this week. The long-delayed September Personal Consumption Expenditures (PCE) Price Index data—the Fed's preferred inflation gauge—is scheduled for release and will heavily influence rate expectations.

Earnings will also be in focus as quarterly reports are wrapping up this week. Earnings from CrowdStrike (CRWD) and Marvell (MRVL) are due Tuesday after the close while Salesforce (CRM) and Snowflake (SNOW) report on Wednesday after the bell. Retailers Dollar Tree (DLTR), Five Below (FIVE) ,and Dollar General (DG) release quarterly reports on Wednesday and Thursday and give a health check on the consumer.

As we head into the final month of the year, the benchmark S&P 500 is up 16.5% as of Friday’s close and is just 1% from its all-time high. Despite the weakness this morning to kick off the final month of the year, the S&P 500 has a strong seasonal bias for December, historically averaging about a 1.2% gain, making it the third-best month of the year. Overall, the consensus among many analysts points to continued, though perhaps less spectacular, gains in 2025 and 2026, supported by strong corporate earnings, easing interest rates and potentially positive AI fundamentals. However, investors may need to brace for ongoing volatility as macro uncertainty clashes with momentum and extended valuations.

Morning Minute

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.