- Market Minute

- Posts

- Tech into 2026: Can A.I. Again Launch Listless Nasdaq-100 (NDX) To New Highs?

Tech into 2026: Can A.I. Again Launch Listless Nasdaq-100 (NDX) To New Highs?

The Nasdaq-100 (NDX) finished 2025 with a roughly 20% gain, but the once red-hot market has cooled as price continues a sideways drift that has been in play since the all-time highs in late October. The rise of artificial intelligence easily claims the title of the most important theme of the trading year for this tech-focused index along with the scramble to secure the critical rare earth minerals needed to make the advanced computer chips upon which A.I. depends. The initial tariff news shock event in April now seems like a distant memory, with price making a blistering +53% rally from the lows near 16,542.

Price has compressed in a triangular range after hitting those aforementioned all-time highs of 26,182.10 on Oct. 29, but from there has stalled out into lower highs; first in early December around 25,800 and currently around 25,700. Momentum also revealed potential cracks starting to show, as the Relative Strength Index showed bearish divergence heading into the highs. The RSI now continues to trend downward but recently crossed above the 50-midline that divides bullish/bearish momentum.

Despite the slump from the highs, there is an accompanying upward trendline making higher lows. Price first held support at significant old highs from August near 24,000 in late November, and more recently bottomed out near 24,650 on Dec. 17. As price contracts into this increasingly shrinking range, traders will be looking for a potential breakout from either of these boundary lines.

Looking ahead to 2026, the options market shows a potential expected move of about +/-750 (3%) for the Jan. 16 expiration. This boundary of around 24,630 to 26,130 very roughly matches up with the all-time highs and the recent Dec. 17 lows. For the Feb. 20 time horizon, the expected move is about +/-1,500 (6%) for a range of about 23,900 to 27,000. The upper edge would be new highs, while the lower edge lines up with the late November lows.

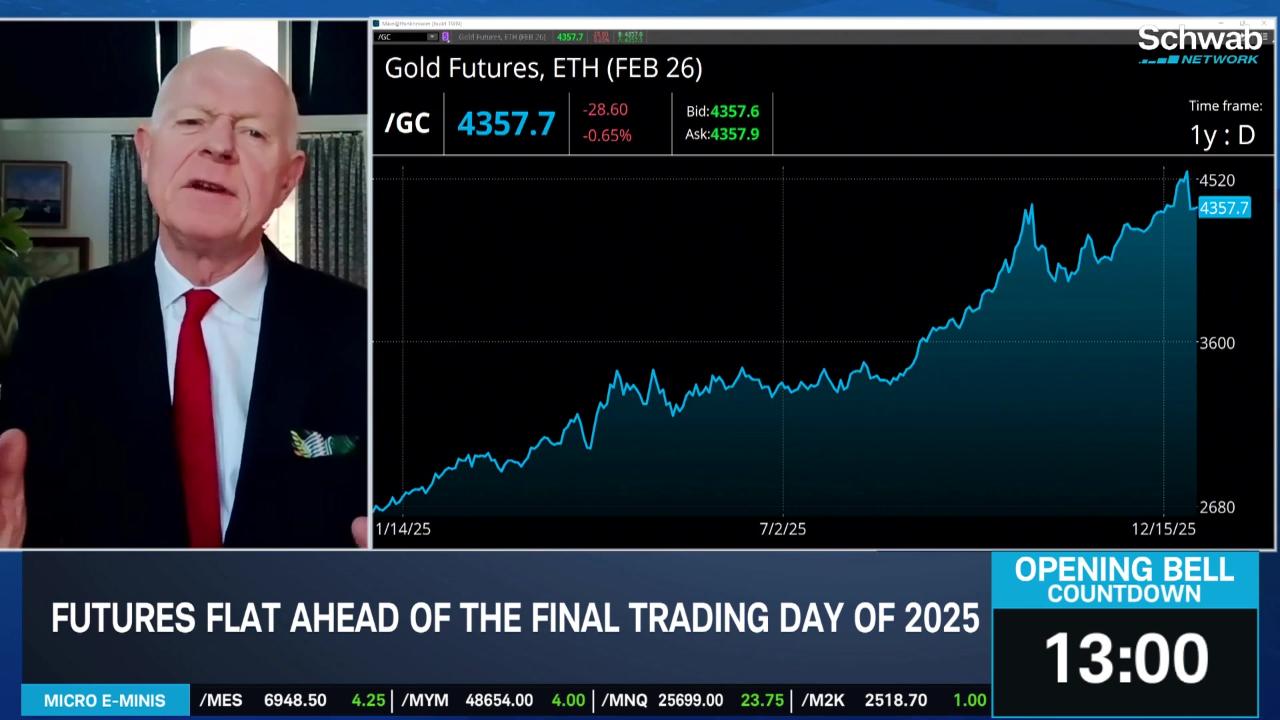

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.