- Market Minute

- Posts

- Tesla (TSLA) Annual Meeting Today as Musk’s Trillion Dollar Pay Package Hangs in Balance

Tesla (TSLA) Annual Meeting Today as Musk’s Trillion Dollar Pay Package Hangs in Balance

Tesla’s (TSLA) annual meeting is slated for today, with shares up a modest +0.4% in early trading as shareholders prepare their final decisions about the proposed trillion-dollar pay package for CEO Elon Musk. The unprecedented compensation agreement would grant Musk, who is already the world’s richest person, more than 423 million new shares of Tesla that would be worth about one Trillion ($1,000,000,000,000). But the deal comes with the caveat that he must meet major growth milestones for the company. This will be no small feat, as the conditions include raising Tesla’s market value to $8.5 trillion from its current $1.4 trillion ranking as well as pushing one million of its self-driving cars into commercial operations.

Many prominent voices on Wall Street have come out both in favor and against the controversial pay package. For example, Ark Invest CEO & CIO Cathie Wood this morning said on news programs that Musk deserves the payment and has previously said she is confident the package would pass. Wood has often been a vocal supporter of Tesla, which is the top holding in her firm’s flagship Ark Innovation ETF (ARKK) coming in at about 13% of its total weight.

However, others like Ross Gerber, CEO/President of Gerber Kawasaki Wealth and Investment Management, have offered harsh criticisms of the idea. Gerber yesterday said he finds it “amazing” that Tesla is “struggling to sell cars” while spending money on digital ads attempting to woo shareholders into approving Musk’s proposed deal. Gerber, a longtime Tesla bull whose tone has shifted to criticism in recent years, has significantly trimmed his firm’s holdings in the electric vehicle maker and unloaded more than 26,000 shares (roughly 10% of its stake) in the first quarter of 2025.

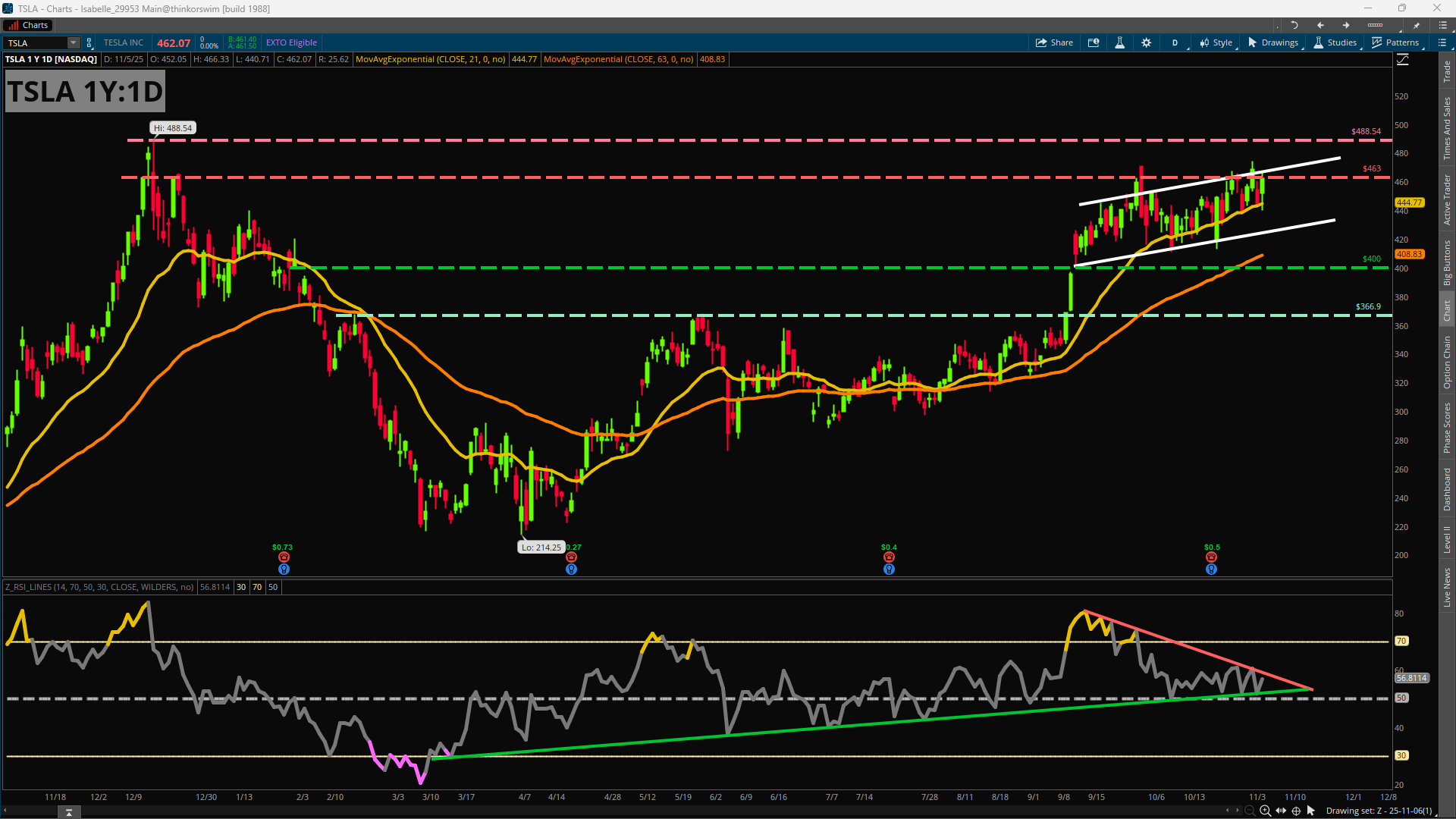

Tesla’s recent price activity has shown a modest upward sloping channel but has recently stalled out around some old highs near $463. This area represents some notable high closing prices from December as well as a recent test from early October. Earnings late last month did not translate into any significant breakouts, while the RSI paints a picture of slowing momentum. The indicator shows lower highs as price makes higher highs, which is a mismatch called bearish divergence and is typically regarded as a potential warning sign. However, at the same time, it also has been grinding higher for most of the year and remains above the 50 midline even as the reading compresses in an increasingly narrowing range.

Downside support could be found at the 21-day Exponential Moving Average near about 445, as well as the 400 level that represents the low point before a gap down in early February, as well as the low after its most recent gap upward. To the upside, the previously mentioned 463 area stands out as potential resistance on the road to the intraday all-time high of $488.54 from last December.

Morning Minute

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.