- Market Minute

- Posts

- Tesla (TSLA) Earnings: It’s All About the Future Vision

Tesla (TSLA) Earnings: It’s All About the Future Vision

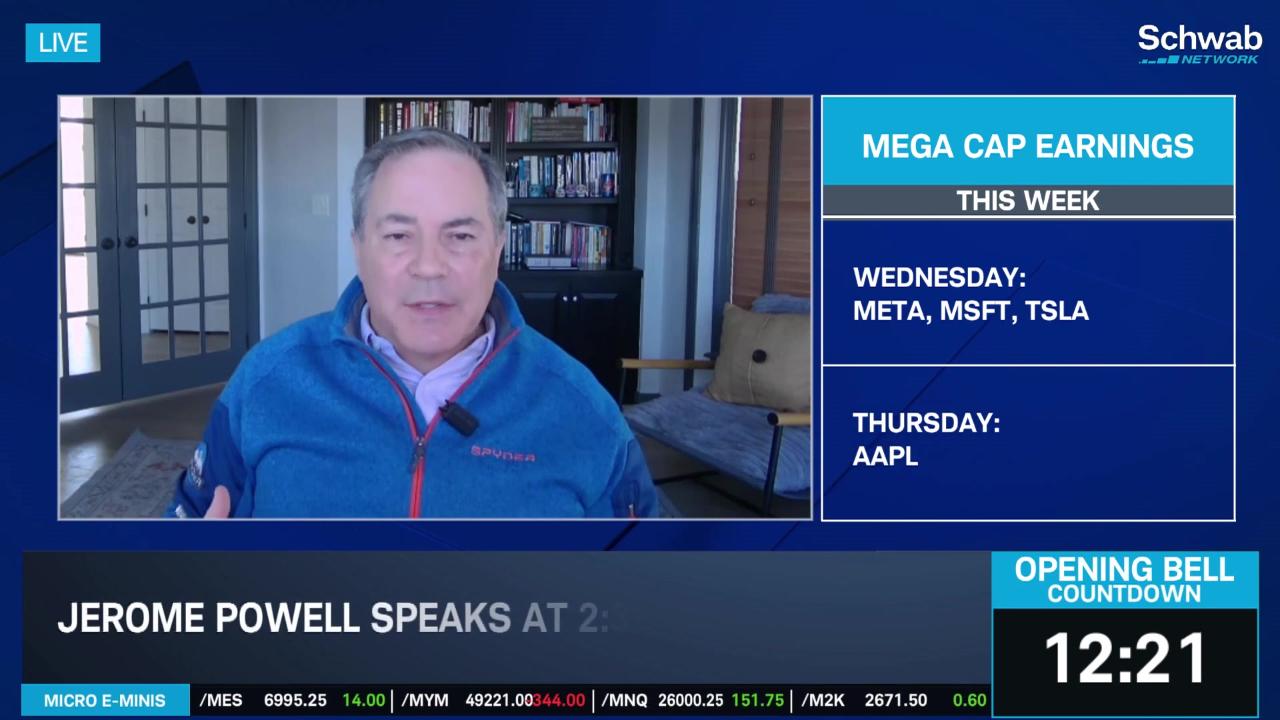

Tesla (TSLA) reports earnings after the bell today, and unlike Mag 7 peers, the Street anticipates a contraction. Zacks expects EPS of $0.45, an almost 40% drop vs last year, and revenue of $25.14 billion, -2% vs last year.

Pressure on electric vehicles persists. General Motors (GM) reported a $7.2 billion special charge in its earnings yesterday related to EVs. The storied automaker cited slowing demand and a need to realign its strategy. The end of the EV tax credit is beginning to show its impact.

In addition to the struggling U.S. sector, Tesla is losing the crown abroad: Chinese-based BYD outsold Tesla in 2025 by 620K units.

Of interest: because of the rules around carbon credits, Tesla can sell other, gas-burning car companies emission credits if it overproduces zero-emission vehicles. That’s been a tidy chunk of revenue, but due to the Trump administration’s changes to environmental policies, the value of those credits is falling. At the same, Tesla is also producing less cars than the Street estimated.

Tesla doesn’t have other types of vehicles to fall back on: it has technological innovation, or its charging and power storage network. The latter may provide some stability in the report while investors look to the future of the former. Musk’s enormous pay package is tied to AI and robotic technology it hasn’t rolled out or perfected yet.

While it has grand ambitions for Robotaxis, Tesla is looking to build other sources of revenue and is settling on a subscription model. We have seen tech as a whole shifting to subscription models over the last few decades, and now it’s coming to cars: their Full Self-Drive software will become a subscription instead of coming with the standard vehicle.

Right now, Musk says FSD will be $99/month, but he said on X the price will rise as the system becomes better. Keep in mind that it is using driving data from its vehicles to refine the software, allowing it to profit both from the data collection and the software use.

At the same time, Tesla is also ending its Autopilot software, which has been mired in lawsuits and federal investigations for years. It also faces other probes, including an NHTSA investigation into its mechanical door release that could be causing problems for first responders.

Tesla is also sometimes used as a proxy for other Musk companies, which are all financially entangled to some degree. Traders may see moves related to excitement around a potential SpaceX IPO, or lawsuits facing the social media platform X. All that can complicate some of the moves the stock sees.

As its auto business matures, Tesla investors are looking to Musk to keep the company a tech and AI play as the stock trades around 200x earnings. Guidance will be intensely important on the call, along with any proof of concept updates on Robotaxis or humanoid robots. Musk needs investor faith and buy-in on the company’s transformation.

Right now, the options market is implying a post-earnings move of around +/- $23, or around 5%. The stock is up 8% since last January, but is down 4% year-to-date.

Join the Schwab Network for live earnings breakdowns and more!

Morning Minute

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice. Investors should review investment strategies for their own particular situations before making any decisions.

Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.

Charles Schwab Media Productions Company and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.

Data contained herein is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. All events and times listed are subject to change without notice.