- Market Minute

- Posts

- The Missing Jobs Report Rally

The Missing Jobs Report Rally

U.S. markets have leaned into a dovish narrative as labor indicators softened and the federal shutdown halted September monthly labor data. The Employment Situation report won’t print today, removing a typical volatility event and forcing investors to triangulate the labor backdrop from private and high-frequency sources.

With the Fed already in easing mode after September’s quarter-point cut and signaling sensitivity to labor softness, markets treated the labor market data blackout as a reason to extend a “slowdown-but-not-shock” stance rather than a cause for panic.

The final major government read before the shutdown was the September 30 JOLTS report, and it pointed in the same direction of weaker labor demand. Openings slipped while layoffs edged higher. More importantly for the sake of momentum, the hires rate continued to glide lower, breaking from the mostly flat 2024 trend. The collection of labor data keeps telling the same story, which is firms are posting fewer jobs, churning a bit more, and pulling back on actual hiring even before shutdown distortions kick in.

With the BLS sidelined, private gauges took center stage. ADP’s September National Employment Report surprised sharply to the downside with a 32,000 drop in private payrolls and an associated annual pay gain of 4.5%. ADP also executed its annual re-benchmarking which flipped August from a gain to a slight loss, reinforcing the idea that hiring momentum had already faded. Sector details showed losses across both goods and services, with only education and health care posting a notable gain, consistent with patterns seen in official data earlier this year. Markets read the print as demand-side weakness rather than a spike in joblessness, and yields fell while equities firmed touching new highs on major indices.

To gauge joblessness in real time, the Chicago Fed’s new nowcast pegged the September unemployment rate at roughly 4.34%, essentially unchanged from August’s 4.32%. That estimate (only the second monthly release of the metric) suggests labor supply conditions have not broken, but it’s labor demand that’s cooling.

The steadiness here fits together with claims data throughout the month. Initial filings spiked to 263–264k in early September, then retraced to 231k and 218k by mid- and late-month, leaving the four-week average drifting only modestly higher than a year ago. Together, those series point to a labor market that is loosening primarily via reduced hiring and lower churn, not a sudden surge in unemployment.

Rates and risk assets have traded labor market messages in textbook fashion. Treasuries rallied after the ADP downside surprise and amid the prospect of fewer near-term macro catalysts during the shutdown, with intermediate maturities leading and equities grinding higher on the view that weaker labor demand and contained joblessness keep the Fed on track to ease again. If economic data points to gradual cooling and not a cliff, markets are likely to keep rewarding duration in fixed income and high-quality growth while the Fed edges policy toward neutral.

Morning Minute

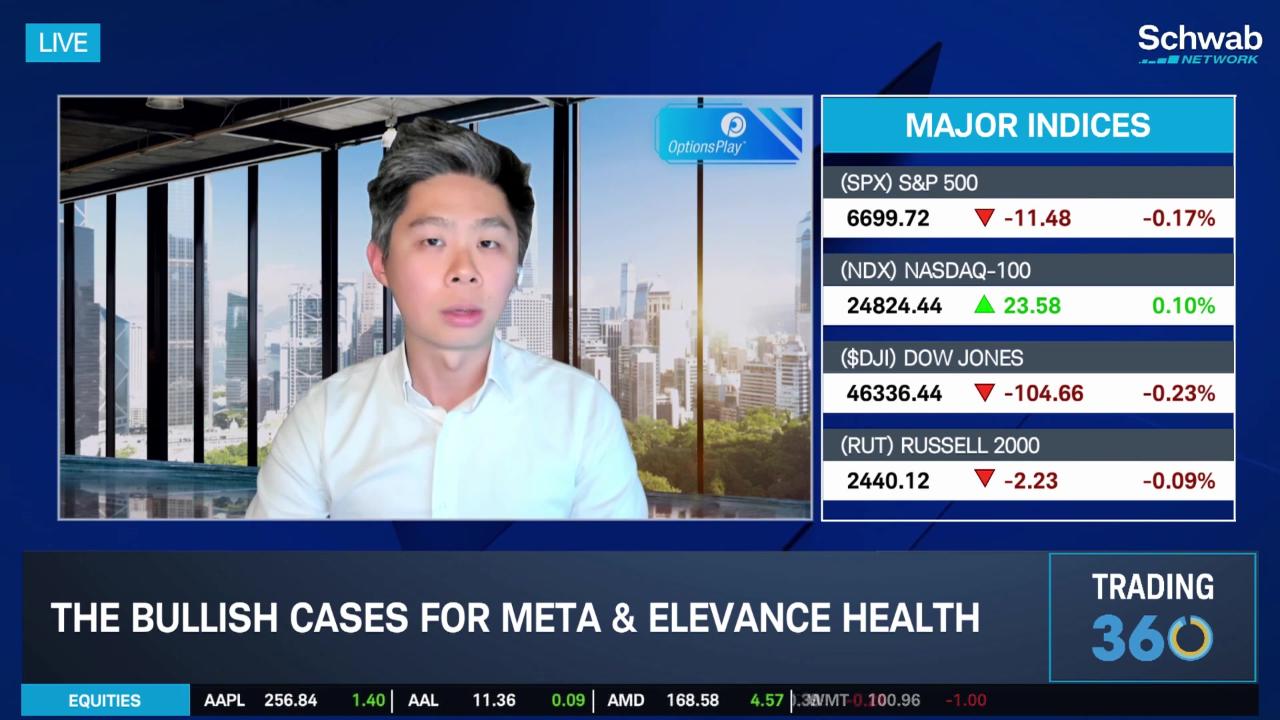

Featured Clip

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.