- Market Minute

- Posts

- Treading Carefully: The Fed Navigates a Twisted Economic Path

Treading Carefully: The Fed Navigates a Twisted Economic Path

The Federal Reserve’s latest Federal Open Market Committee (FOMC) statement arrives at a time of nuanced macroeconomic complexity, and it reflects just that. In contrast to previous communications, the Fed has now chosen a more balanced tone, striking a middle ground between its twin mandates of fostering economic growth and controlling inflation. The choice of language in this month’s statement signals a cooling of immediate concerns, even as the central bank acknowledges that uncertainty, though diminished, remains a significant force in the background.

The changes, while subtle, are noteworthy. In May, the Fed noted that “uncertainty about the economic outlook has increased further,” highlighting dual concerns about rising joblessness and inflation. The latest statement, however, tones this down: “Uncertainty about the economic outlook has diminished but remains elevated,” and “the Committee is attentive to the risks to both sides of its dual mandate.”

This shift is more than a matter of semantics—it’s a calculated signal that the Fed sees marginal improvement in economic conditions while also recognizing lingering risks. It’s a delicate recalibration, one that reflects the latest data showing inflation inching higher and GDP projections being revised downward, while unemployment remains steady.

While headline CPI inflation did tick up slightly in May, it still undershot expectations, suggesting that inflationary pressures, though persistent, may not be accelerating dangerously. At the same time, the unemployment rate has held steady for three consecutive months. That kind of labor market resilience allows the Fed breathing room to adopt a wait-and-see stance rather than rushing into additional policy shifts. However, the Fed’s updated economic projections reveal deeper concerns about the trajectory of the real economy, particularly in the realm of trade.

The Fed now forecasts GDP growth of 1.4% for the year, a cut from the previous estimate of 1.7%. The downward revision, as Fed Chair Jay Powell pointed out, stems largely from a swing in net exports which is a direct consequence of evolving trade dynamics, including tariffs. Despite this, the Fed did not revise its policy rate expectations. Part of the reason lies in the continued strength of private domestic demand, which offsets some of the drag from weak net exports.

Additionally, the unemployment forecast for the year has only been adjusted marginally, further indicating that labor market fundamentals remain robust even as headline growth weakens. Projections for GDP next year expect sub-trend growth at 1.6%. This explains why the median projection for the Fed Funds rate edges down to 3.6% in 2026 from 3.9% in 2025, though it still remains above the earlier projection of 3.4%. The Fed is clearly signaling a future of soft growth and cooling inflation conditions that would justify a more accommodative policy stance – just not yet.

Inflation, on the other hand, presents a more complicated picture. The Fed now expects the Personal Consumption Expenditures (PCE) inflation rate to rise to 3.0% from a prior forecast of 2.7%. Core PCE, which strips out volatile food and energy prices, is also now expected to come in at 3.1%, up from 2.8%. These figures are clearly above the Fed’s 2% target, but the central bank remains unfazed in the short term. It attributes the recent uptick largely to temporary factors, particularly tariffs, and continues to assert that “longer-term expectations remain consistent with our 2% inflation goal.” By 2027, both headline and core inflation are projected to settle around that target.

This outlook suggests that the Fed is reluctant to either raise or cut rates in the near term. The Fed’s preferred rate forecasting tool, the dot plot, shows no appetite for rate hikes and only a modest expectation for cuts, potentially as we head into 2026. The CME’s FedWatch tool mirrors this sentiment, assigning overwhelming probability to unchanged rates in upcoming meetings. While there remains an approximate 8.3% chance of a 25-basis point cut, that seems more like a hedge than a genuine expectation, especially with inflation still running above target and GDP weakening but not collapsing. For now, the Fed appears to be in a holding pattern, content to monitor developments rather than act preemptively.

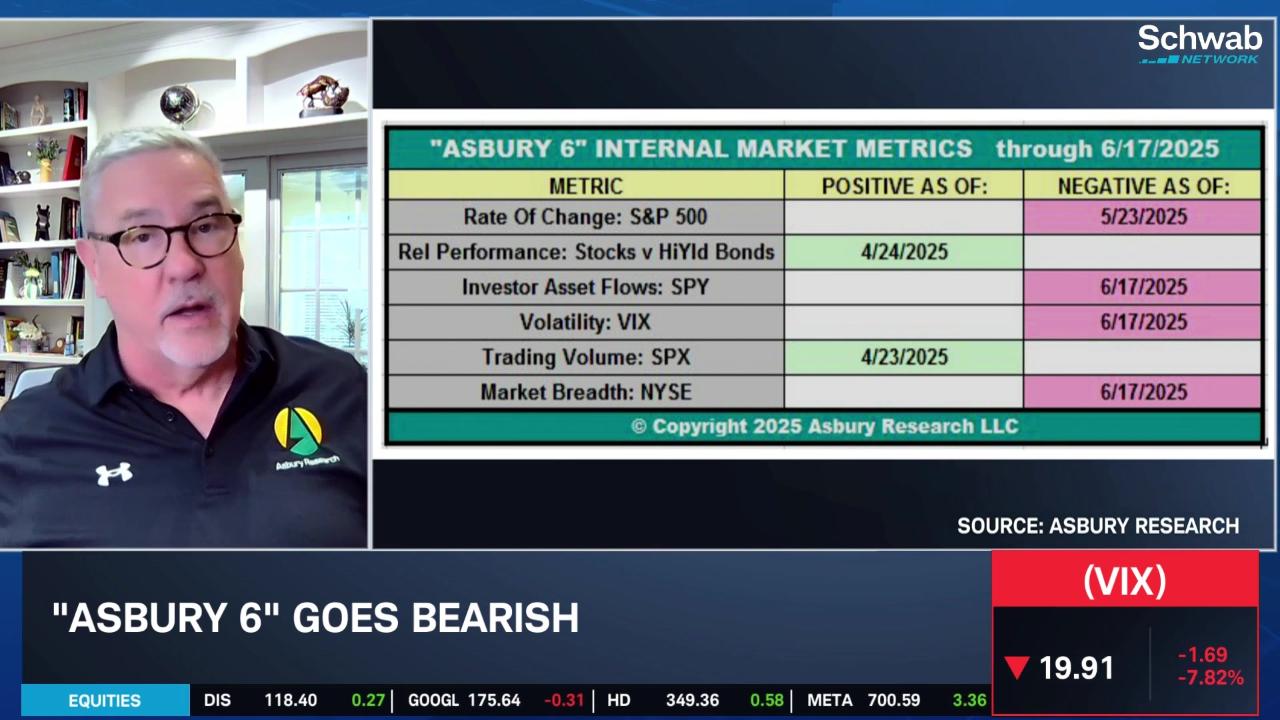

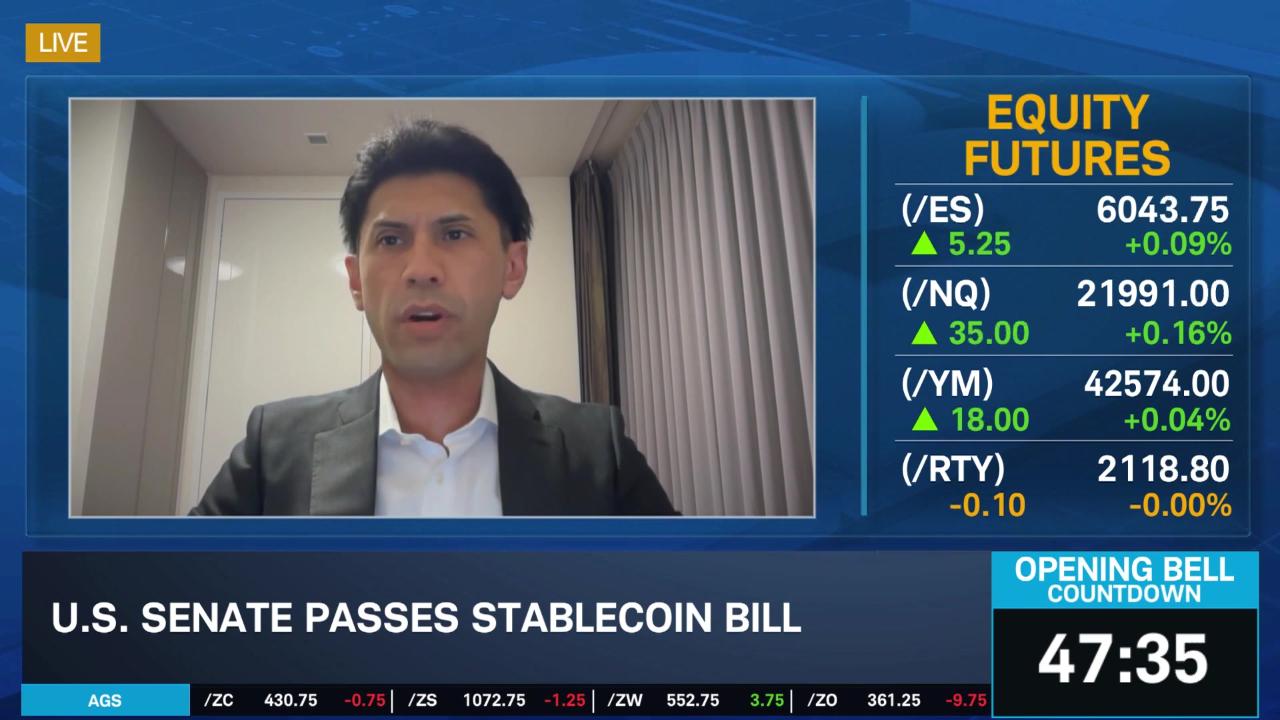

The market’s complete lack of reaction to the FOMC announcement is telling. Stock indices barely budged. The S&P 500, NASDAQ, and Dow Jones Industrial Average were essentially flat. The Fed’s measured tone had been well anticipated, and investors had already priced in the probability of steady rates. The reaction, or lack thereof, speaks volumes about the Fed’s current success in guiding expectations. They are doing just enough to manage risk without unsettling markets.

Morning Minute

Featured Clips

Tune in live from 8 a.m. to 5 p.m. ET, or anytime, anywhere, on‑demand.

Or stream it via thinkorswim® and thinkorswim Mobile, available through our broker-dealer affiliate, Charles Schwab & Co., Inc

Please do not reply to this email. Replies are not delivered to Schwab Network. For inquiries or comments, please email [email protected].

See how your information is protected with our privacy statement.

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions. Schwab Network is brought to you by Charles Schwab Media Productions Company (“CSMPC”). CSMPC is a wholly owned subsidiary of The Charles Schwab Corporation and is not a financial advisor, registered investment advisor, broker-dealer, or futures commission merchant.